Abstract

Ecommerce benchmarks help brands gauge performance versus their competitors. Though brands often benchmark using aggregate numbers alone, we believe it is equally important to use industry-specific benchmarks.

To investigate the differences between industry verticals, we looked at two in particular — Cosmetics & Beauty and Outdoor — and compared them to each other and to the All Stores dataset. Specifically, we reviewed Spend and Revenue distributions across all three datasets, then looked at aMER for both Outdoor and Cosmetics & Beauty.

We found that each vertical had different spend and revenue patterns, most noticeably when comparing Outdoor against Cosmetics & Beauty. The Outdoor vertical spent more money on Facebook and relied more on New Customers for their revenue; Cosmetics & Beauty spent the most on non-Facebook and Google ad channels, while the majority of their revenue was from returning customers.

Furthermore, the Outdoor vertical had 157% higher aMER than Cosmetics & Beauty. Since the Outdoor vertical relies on new customers for close to 80% of its revenue, it must have a higher aMER to be first-order profitable. Cosmetics & Beauty can work with a lower aMER since it has returning customer revenue to generate profit once those new customers are acquired.

If a brand were to benchmark against only the All Stores vertical, it would miss these important nuances that are drastically different in industry-specific verticals.

Table of Contents

- Introduction: Verticals vs. Aggregates

- Our Approach: A Dive Into 3 Verticals

- Results: A Tale of 3 Verticals

- Discussion: Comparing Verticals

1. Introduction: Verticals vs. Aggregates

How are my competitors spending their money and where is their revenue coming from?

Most brands are blind to this: they spend and receive money on their own metaphorical island, unaware of where they stand relative to the larger ecommerce world.

And, although each brand is unique, aggregate data allows for spend and revenue expectation-setting that reflect broader trends.

However, it’s not enough to simply use aggregate data: We believe that the performance difference between industry verticals is profound enough to merit using vertical-specific data for benchmarking purposes.

2. Our Approach: A Dive into 3 Verticals

The verticals for this investigation

To observe how these Ecommerce metrics vary across verticals, we’re going to look at 3 verticals in particular:

- All Stores

- Outdoor

- Cosmetics & Beauty

The metrics we will focus on

We are going to compare these verticals across three key metrics:

- Spend Distribution: between Google, Facebook, and other channels

- Revenue Distribution: between new and returning customers

- aMER: we’ll look at this only between the Cosmetics & Beauty vs. Outdoor Verticals

The time frame

We’ll be looking at these metrics and verticals in late May 2023 into June of 2023 to draw this comparison.

We pulled this data from a list of stores that had consistent connections to our Statlas.io database for the last 2 years for their storefront (Shopify), Facebook Ads, and Google Ads. This pool of stores accounts for around $4.28 Billion in Store Revenue and $552 Million in Ad Spend.

3. Our Results: A Tale of 3 Verticals

Each of the verticals we looked at was at least slightly different. We highlight some of those differences here through the metrics of Spend and Revenue.

We’ll start with the “All Stores” vertical, as that is the most inclusive vertical and creates a solid baseline for comparing the other verticals.

All Stores: Tale of the Aggregate

Our All Stores vertical in the DTC Index includes every store that has consistent data over the last 2 years — it’s a good representation of Ecommerce as a whole.

Here’s a breakdown of how most Ecommerce businesses spend their ad dollars:

Obviously, stores spend more money on Facebook than Google. The other platforms (Tiktok, Pinterest, Snapchat, Bing, Twitter, etc.) see some experimentation, but not much.

That acquisition spend is clearly working to some extent: A slight majority of revenue, over both the last 28 days and the last 12 months, comes from New Customers:

With a baseline set, let’s look at the Outdoor vertical.

Outdoor loves adventurous customers

The Outdoor Industry looks very different from our All Stores vertical and different from year to year.

First, the spend this year has been composed of more Facebook compared to last year:

That’s partly because we’ve seen +20.79% better Facebook ROAS than last year in the Outdoor vertical.

Facebook ROAS is particularly bolstered by some peak moments (Memorial Day and Father’s Day / Juneteenth) that lifted ROAS above last year, running an average of 3.61 this year.

Ad spend is particularly important for the Outdoor vertical because they rely heavily on new customer revenue:

Ultimately, this is likely because outdoor equipment is something you buy with the hope that it will last multiple years: kayaks, paddleboards, coolers, etc.

Cosmetics & Beauty allures for a lifetime

The consumable nature of Cosmetics & Beauty products creates a very different environment for selling and reselling to customers. This impacts both spend and revenue in that vertical.

Let’s take a look at the spend distribution for that vertical:

The first thing of note: This vertical spends more into “Other” ad channels than any other vertical. This is likely for two reasons:

First, the nature of Beauty & Cosmetics is to remain fashionable and forward-thinking. Those brands are willing to test out ads on other platforms that are overlooked by brands in many other verticals.

The second reason for trying out “Other” channels is informed by the Revenue distribution in Cosmetics & Beauty.

Cosmetics & Beauty receives the majority of its revenue from Returning Customers. Let’s discuss more about how that compares to the Outdoor vertical.

4. Discussion: Comparing Verticals

In the previous section, we looked at the separate verticals; here we’ll dive into a comparison and explanation of the differences.

Instead of viewing spend and revenue for each vertical separately, let’s compare Outdoor vs. Cosmetics & Beauty side-by-side.

In contrast to the Outdoor vertical, Cosmetics & Beauty receives the majority of its revenue from Returning Customers. Since Cosmetics & Beauty has a consistent stream of revenue from existing customers, it can try more exploratory ways of acquiring those new customers without sacrificing efficiency in the majority of its revenue.

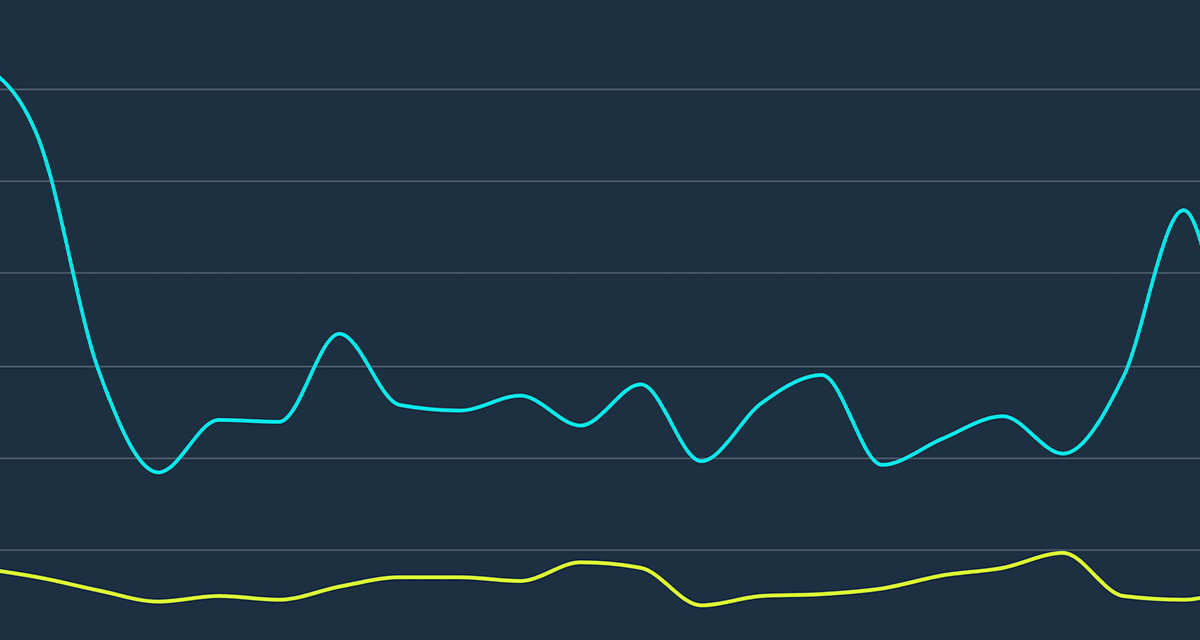

The dramatic difference in new customer acquisition becomes apparent when you compare aMER between Cosmetics & Beauty and Outdoor.

Outdoor vertical had an aMER 157% higher than Cosmetics & Beauty in the last 28 days.

Since the Outdoor vertical relies so heavily on new customers, it needs to acquire those new customers profitably.

On the other hand, Cosmetics & Beauty is a consumable product — purchasers of their product will use the product and likely have to purchase more of that product shortly in the future.

Cosmetics & Beauty can therefore push the limit of profitability on the first order knowing that a large number of those new customers will like their product enough to come back for more.

Cosmetics & Beauty has that stable repeat revenue of customers coming back for more on a regular basis. With that revenue secured, Cosmetics & Beauty has the opportunity to go push their new customer acquisition, running a lower aMER in the process.

Verticals Matter

These distinct differences point out why ecommerce brands shouldn’t just benchmark against overall performance, but also against their individual verticals.