With ecommerce trends pointing towards an uncertain future, this holiday season may be the most challenging one in your brand’s history.

To succeed, you need a North Star — a clear sense of where you’re going and what you need to get there.

That’s why we’ve built you our most comprehensive, most in-the-weeds, most nitty-gritty, dirt-under-your-fingernails holiday planning guide ever …

This article covers everything you’ll need to set yourself up for Q4 success, broken into three parts:

- Holiday Ecommerce Marketing Trends & Consumer Insights

- Online Holiday Shopping Strategy: Target Customers Early

- Black Friday, Cyber Monday Ecommerce Holiday Planning

It’s a roadmap backed by data from $8.2+ billion in advertising spend. It also features original contributions from some of the world’s leading ecommerce brands and growth experts.

More than anything, I hope it contains peace:

Peace, despite the fear and anxiety of the unknown. Peace that comes from not going it alone. Peace in the understanding that things are hard for everyone right now. Peace in knowing that you’ve not only planned well but executed to perfection.

To guide you, we’ve created a Holiday Marketing Ecommerce Bundle that includes:

- 2022 Holiday Marketing Calendar

- 2022 Black Friday Cyber Monday Offer Calculator

- 2.4k Screenshots from Last Year’s Top DTC Holiday Campaigns

1. Holiday Ecommerce Marketing Trends & Consumer Insights

What makes this an “uncertain” season? We dug into the data to find out.

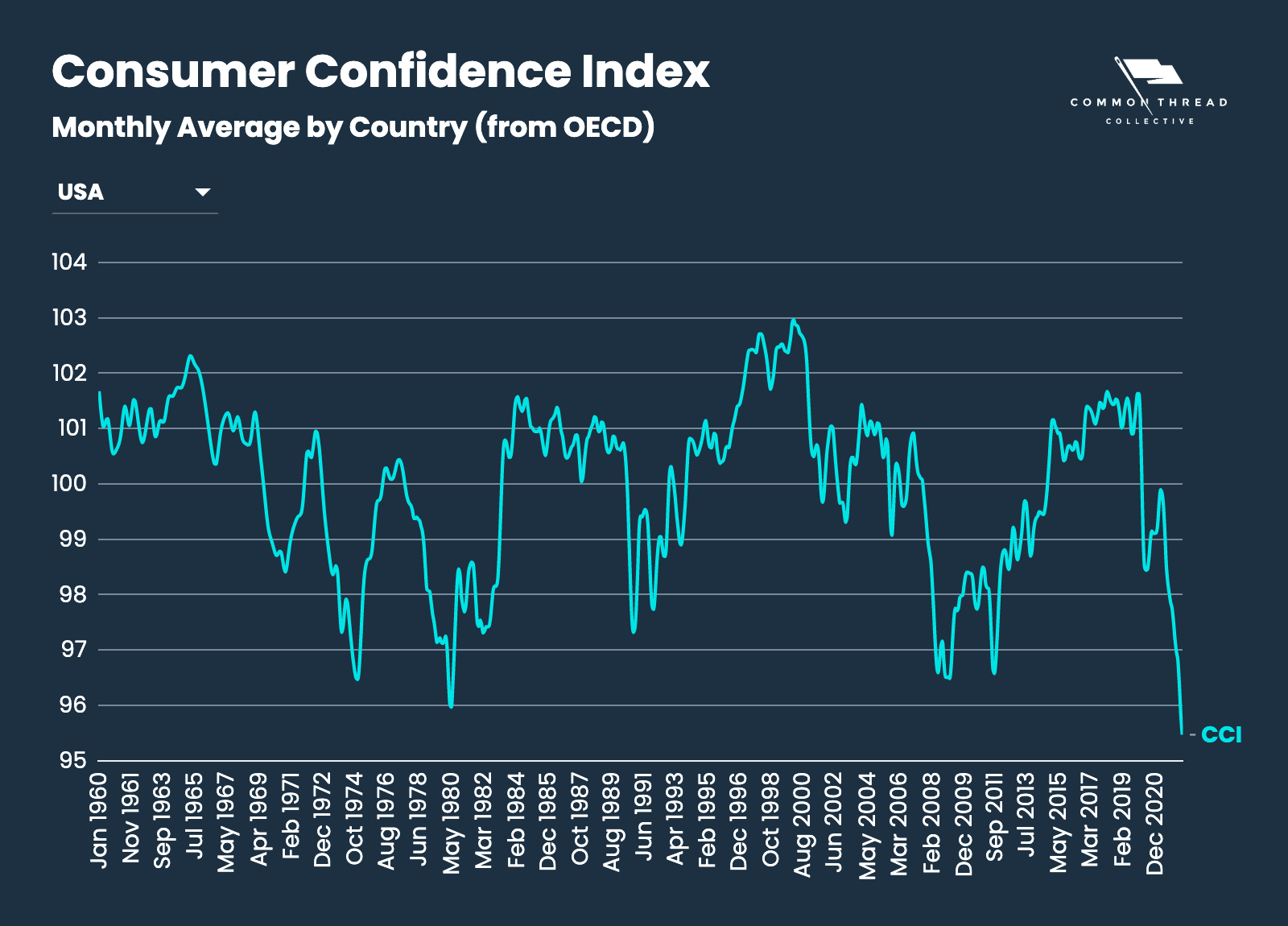

Turns out, the USA recorded the lowest Consumer Confidence Index (CCI) ever in July 2022. This means consumers feel less secure in their future earning potential and financial situation, resulting in a tendency to save more and buy less.

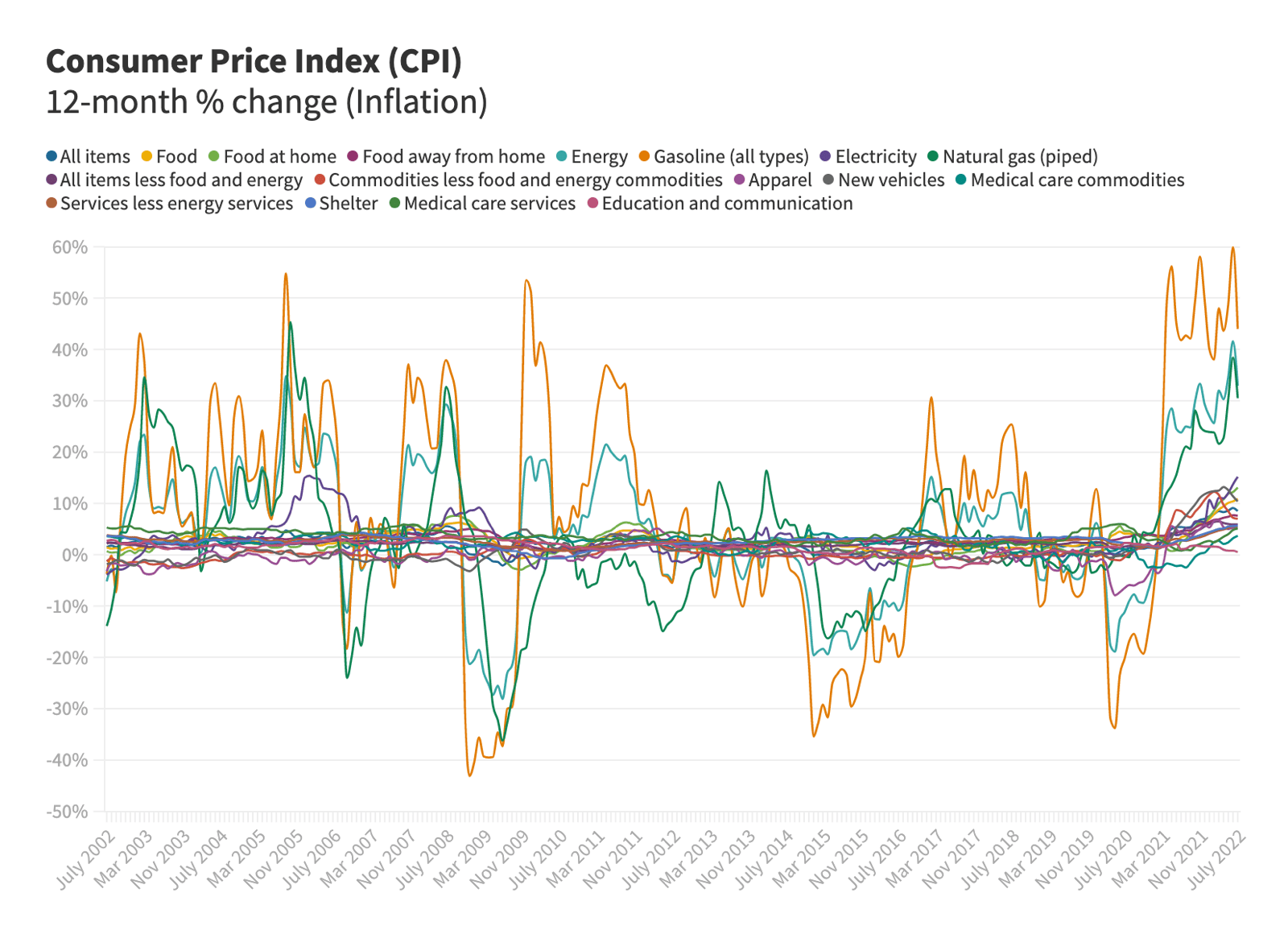

To further prove the point, the Consumer Price Index (CPI) — an indication of inflation — is higher than it’s been in decades. Meaning, consumers are paying more for everyday necessities like gas, energy, and food.

How do these economic indicators impact online marketing?

To answer that question, we took a look at the correlation of MER (marketing efficiency ratio) to CCI. It’s fairly strong. Marketing efficiency lessens as consumer confidence drops.

Theory: If consumers are less confident, it's going to take more marketing resources to sell them products.

How does that affect the cost of ads?

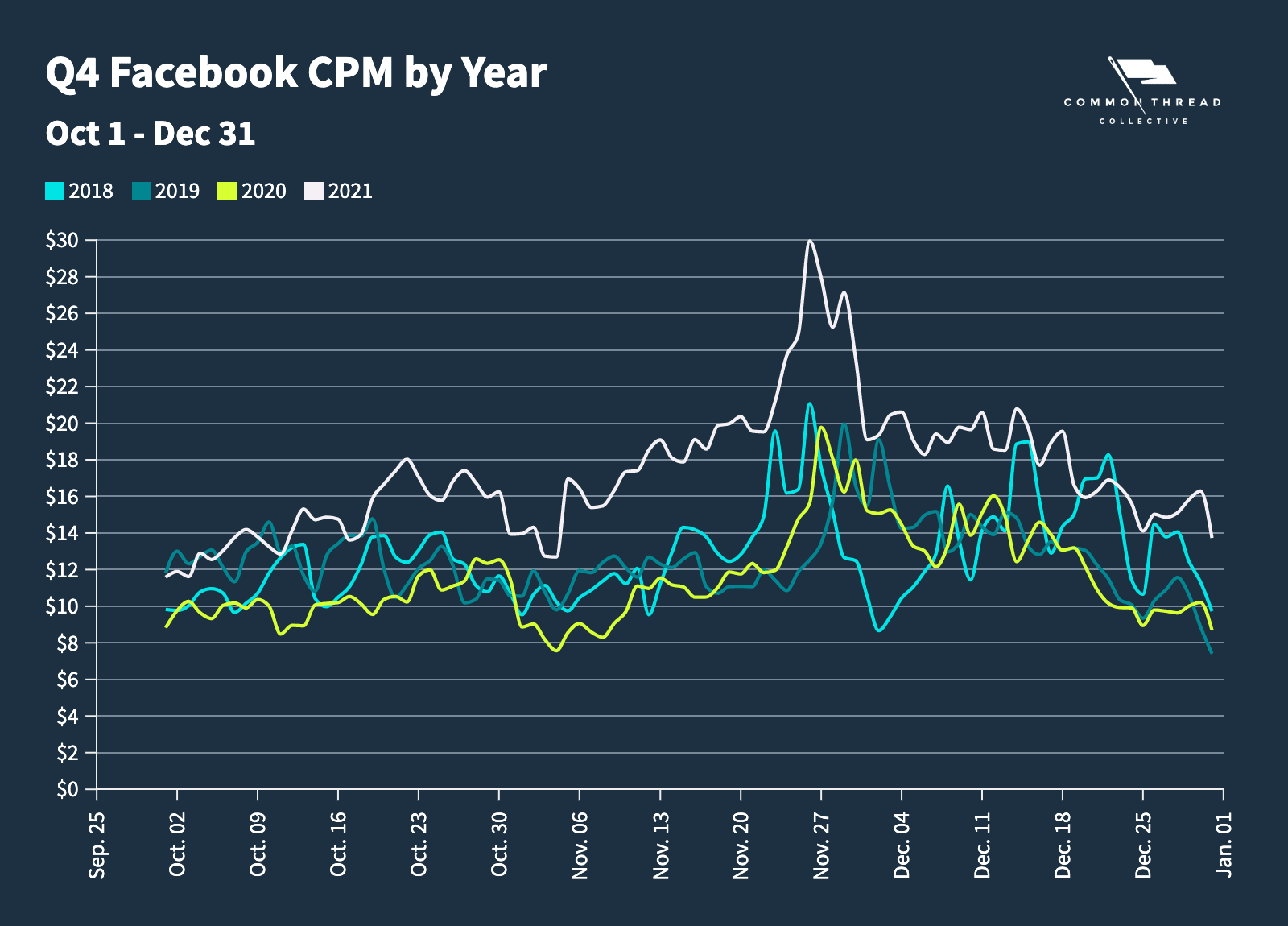

Comparing the past four years — a turbulent time period to say the least — one thing remains true: CPMs have been consistently lower in October and early November compared to BFCM.

This tells us the cost dynamics around Black Friday Cyber Monday have looked similar regardless of the macro environments. Therefore, you can expect something similar this year.

It’s a good thing you’re reading this article now (… hopefully it’s still Sept./Oct.), because all signs point to one universal truth: BFCM success starts by building your customer list before Nov.

Nik Sharma, Founder of Sharma Brands

Black Friday and Cyber Monday are animals of their own species. You can never assume that your Excel sheet projections will match up with your BFCM sales if they’re based on sales or growth numbers leading up to it.

Most brands leverage the fact that everyone is looking for a discount, but the smarter ones make sure AOV stays high throughout the sale.

While macro trends will give you indicators on what you should be discounting and for how much, micro trends give you better insights into the distribution channels of where you should offer those discounts and with how much spend.

Nate Checketts, CEO and Co-Founder of Rhone

We try to generally stay aware of macro trends by keeping in touch with brands we like, appreciate, respect, and have a similar audience with. However, we prioritize and focus on our internal company data as the lead determiner for any promotional activity, and adjust based on the market reaction.

For example, Rhone's strategy was to reach customers a few weeks ahead of BFCM. We paired macro trends and Rhone data with innovative thinking, resulting in our longest BFCM sale period to date.

No matter the situation, you have to go in with your best strategy and be ready to tailor it to the unpredictable reaction of the market.

Kurt Elster, Founder of Ethercycle & Host of The Unofficial Shopify Podcast

When comparing industry trends with your own strategies, look for the overlap between the two. And then, test those new strategies early to a small segment of your audience.

When approached with industry data, I take it with a grain of salt. Treat it as inspiration or suggestions for marketing tests, not as gospel.

You already know what works in your business. Evolve that by being curious about new opportunities without going so far that you cannibalize your own success chasing shiny toys.

Kristen LaFrance, Director of Community at Repeat

At the macro level, pay attention to what sale formats the big players are tossing out.

How are they communicating those sales? What channels are they using to bring in new (and repeat) customers? Pay just as much attention to where they aren’t as where they are.

That being said, only you know your business the best. And at such a critical point in your sales cycle, don’t let industry trends skew you too far from your own knowledge.

A near majority of BFCM sales come from existing customers, not new customers. Don’t risk a good chunk of these sales by focusing too heavily on “the industry” and turning a blind eye to your own customer base.

Trust your own customers, trust your customer knowledge, test early and often with them. But, keep an eye for curiosity and adventure on the macro trends happening.

2. Online Holiday Shopping Strategy: Target Customers Early

We know that costs and conversion rates peak during BFCM. How do we take advantage of the latter without overpaying on the former?

Simple. Buy your traffic ahead of time.

Think of it this way — last year I wanted to buy a new watch. At some point in Oct. or early Nov., I went to a few websites, clicked around, found the one I wanted, and then …

I didn’t purchase. Instead, I waited.

I made a mental note to check back during Black Friday to find out what the discount would be. When I returned, the watch was 25% off and I happily made my long-awaited, discounted purchase.

We all follow a similar purchase path when it comes to the holiday shopping season; this is why, in the weeks prior to Black Friday, most advertisers see 1-day click ROAS fall well below target.

In response, they reduce budgets in Oct.-Nov. in order to spend big on BFCM itself. The problem?

- CPMs are at an annual high on BFCM

- No one wants a discount on a product they’ve never heard of

- Especially when all the brands they have heard of are also running huge discounts

To meet those challenges, you must accept a lower 1-day ROAS leading up to Black Friday with the knowledge that those customers will return in droves over BFCM.

Push spend pre-BFCM at a lower ROAS. It’ll pay off on Black Friday itself.

Since your ROAS will look bad initially, Lean in by being proactive:

Excite customers through gift guides that preview how good of a deal they’re going to get. Prospect heavily. Stay top of mind leading up to BFCM …

They will come back and buy.

Drive new, qualified customers to your site before BFCM so you can remarket during BFCM. Because we know the cost of traffic is going to spike, potential customers must enter the top of the funnel during Oct. and Nov.

Jake Cohen, Head of Shopify at Klaviyo

Over-invest in acquisition now, and so you can create and harvest demand when it comes through during the holidays. The holidays are the time to convert first, grow your list second.

The time ahead of the holidays is for list growth first, conversions second.

Why? People are looking now and they are not brand loyalists anymore.

Make sure you have an aggressive email acquisition strategy before the holidays: welcome pop-up for new visitors, embedded footer (just in case), and exit intent. Lock in a multi-step welcome series to seal the initial relationship. If you use SMS, collect valid phone numbers and get consent.

In case you missed that, I repeat: BFCM weekend is not the time to focus on driving new traffic. This is your opportunity to retarget all the website traffic you’ve developed over the last two months.

Oct. and Nov. are about acquiring visitors; BFCM is the time to convert them.

Holiday Email Marketing: When to Build Your BFCM List & What to Send

With email, how-to tactics (holiday-themed templates, subject lines, send frequency) aren’t the most useful focus.

Instead, ask these three questions:

- What is the value of an email address?

- When is an email address most valuable?

- And, when is it most valuable to get that email address?

Everyone loves comparing themselves to industry benchmarks when answering the first question.

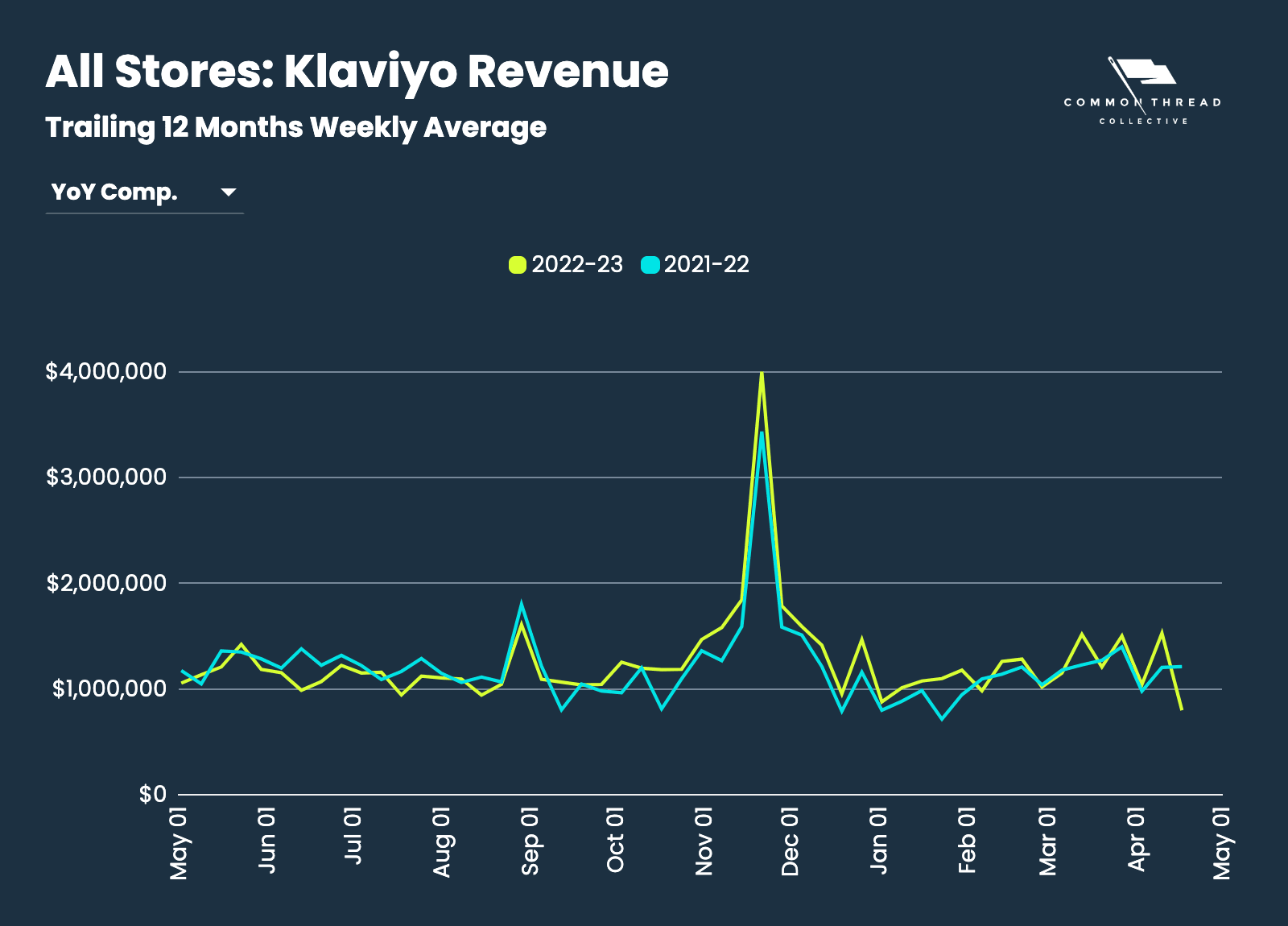

Data we compiled with Klaviyo puts the average value of an email address at ~$4.17. But there are so many variables between brands, it’s an almost worthless data point. Email simply ensures you have a way to contact potential customers again with your BFCM promotions, instead of hoping they come back to you.

Let’s talk about the other two questions and frame them around payback periods: the time between paying to acquire email addresses and generating revenue from them.

The second question is easy.

Email addresses become exponentially more valuable during Q4 than at any other time of year.

For ecommerce at large, 56% of email’s annual revenue is generated in Nov. and Dec. Why? Because 89% of BFCM purchases are made by customers who open an email before the holidays.

Still, it’s the third question where the heart of BFCM lies.

When is it most valuable to get that email address? Answer: October.

Emails acquired in Oct. have the highest three-month value of any period of the year:

Taylor Sicard, Co-Founder of Win Brands Group

If you don’t already have a large email or SMS list, start building it. If you were late to one or the other, focus on the one that you’re good at right now.

You should always be aiming for efficiency. Q1-Q2, that’s CAC vs AOV. In Q3-Q4, how efficiently can we get emails, phone numbers, and traffic for targeted remarketing.

There’s no perfect way to predict what the holiday season has in store for ecommerce sales. The optimal way? Calculated risks.

Identify those who purchase for themselves for the creation of UGC and social proof now. Then, during the holiday season, you can showcase this content to those buying your products as gifts for their loved ones.

Marco Marandiz, DTC Growth Strategist

Macro trends represent average movements of the market. They’re crucial to informing your BFCM strategy broadly, but no two businesses are identical. Therefore, I advise clients to create campaigns that acknowledge trends but stay true to their brand values and unique position.

Standing out with creative — while being spend-optimal — is a beautiful ideal, yet hard to execute on the most competitive holiday of the year.

Macro trend: Email marketers destroy your inbox because they’re unsophisticated.

Micro strategy: Offer exclusive merch at pricing otherwise unavailable to (1) your top ~500 customers as well as (2) non-customers through private FB groups, landing page sign-ups, and in-store collateral.

Three weeks before BFCM, email subscribers a pre-BFCM offer: e.g., 35% off versus your regular BFCM pricing of 25% off.

Acquire as many qualified email addresses as possible in Oct. Even if you lose money in the short term, your payback period will be at its shortest. So you can afford to be aggressive.

Holiday Customer Lifetime Value: What’s a Purchase Worth?

Common sense suggests holiday customers are less valuable over time than non-holiday customers.

Rather than take that assumption at face value, we pulled data on DTC brands from 2021 and compared the average LTV increase as a percent of first-purchase AOV over three time periods:

- 60 days

- 90 days

- Lifetime

Then, we examined three cohorts by date of first purchase:

- Non-holiday customers

- BFCM: Thanksgiving - Following Wednesday

- Gifting: BFCM end - Dec. 19

Non-holiday shoppers prove the assumption they’re more valuable over time than BFCM shoppers. But not by as great a margin as you’d expect.

For more clarity, we calculated the delta between non-holiday versus holiday LTV:

In ecommerce, 60-90 day payback windows are essential to cash flow. Within that range …

BFCM shoppers are worth only 3%-6% less than their non-holiday counterparts. And gifting customers, 3%-5% less.

Holiday shoppers may not be as disloyal as we think.

The major caveat lies in lifetime (180-day) LTV. You’ll see roughly 20% less value in the long-term from these shoppers.

If you're curious about how LTV plays into your larger ecommerce marketing strategy ... on top of Black Friday email marketing itself, we’ve written extensively about email list building, the power of personalized quizzes, and email’s connection to retention:

- Love Wellness: 1,290% Growth (Email Campaign List Building)

- Bambu Earth: 29x Revenue via 60-Day LTV (Quiz & Emails)

- Customer Lifetime Value for Ecommerce: Beyond LTV:CAC

- Ecommerce Retention: 10 Strategies That Don’t Take a ‘Lifetime’

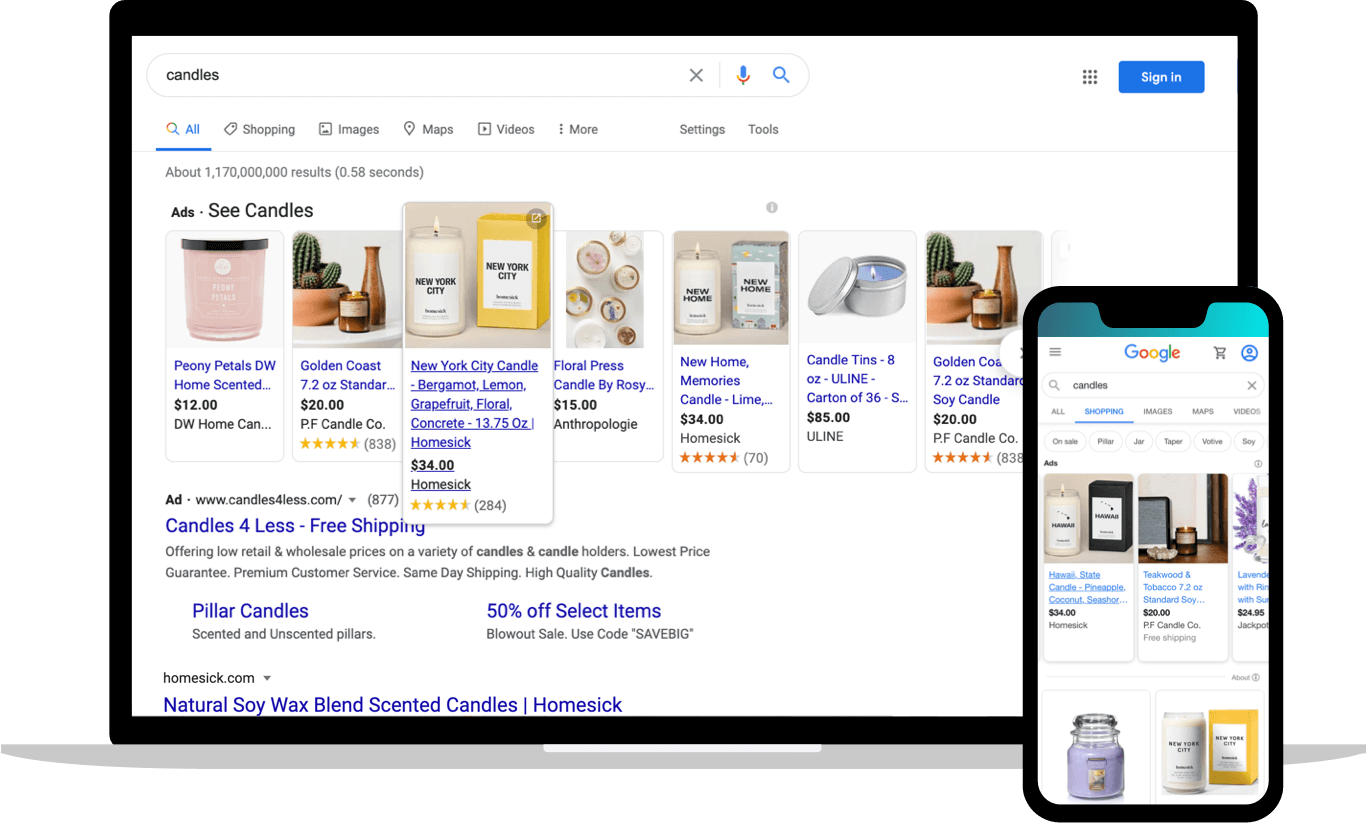

Google Ads Holiday Conversion Rate YoY

Google is the GOAT of demand capture any time of the year, but especially for the holidays. While it is competitive to advertise on Google during the holidays, conversion rates are at an all-time high.

On Google, bid for maximizing clicks to optimize for the most traffic possible. Spend more than usual to capitalize on this opportunity.

And forget target ROAS or CPA bidding, especially on your branded search terms — volume is the game, not efficiency.

Tracey Wallace, Director of Content Strategy at Klaviyo

Nothing happens in a vacuum. Your strategy for any campaign, including holiday, is about how you mix the macro with the micro of your brand, your messaging, and your offer/conversation starter.

Think of REI. Its #OptOutdoors was such a successful holiday marketing campaign. It resonated with their brand (micro), but it hit on a much larger trend (macro) — digital wellness.

For your own brand, start with the macro trends happening in your space that are top of mind for your customers and prospects. Then, think through what your brand’s take on it is, why it matters (this part is important!), and the action folks can take.

Of course, you want people buying more of your products. But they are getting bombarded by emails, ads, campaigns — all talking about the holidays and gifts for XYZ person in their life.

Tying your campaign back to a larger trend that your brand is aligned with (and as a result, your customers are aligned with), makes your campaign stand out and drive more sales, all while increasing loyalty and building your tribe.

Facebook Metrics: Your Ideal Holiday Ad Dashboard

The core of our holiday strategy: drive cheap (but qualified) traffic prior to BFCM. Then, reap the rewards of converting that traffic during the sale.

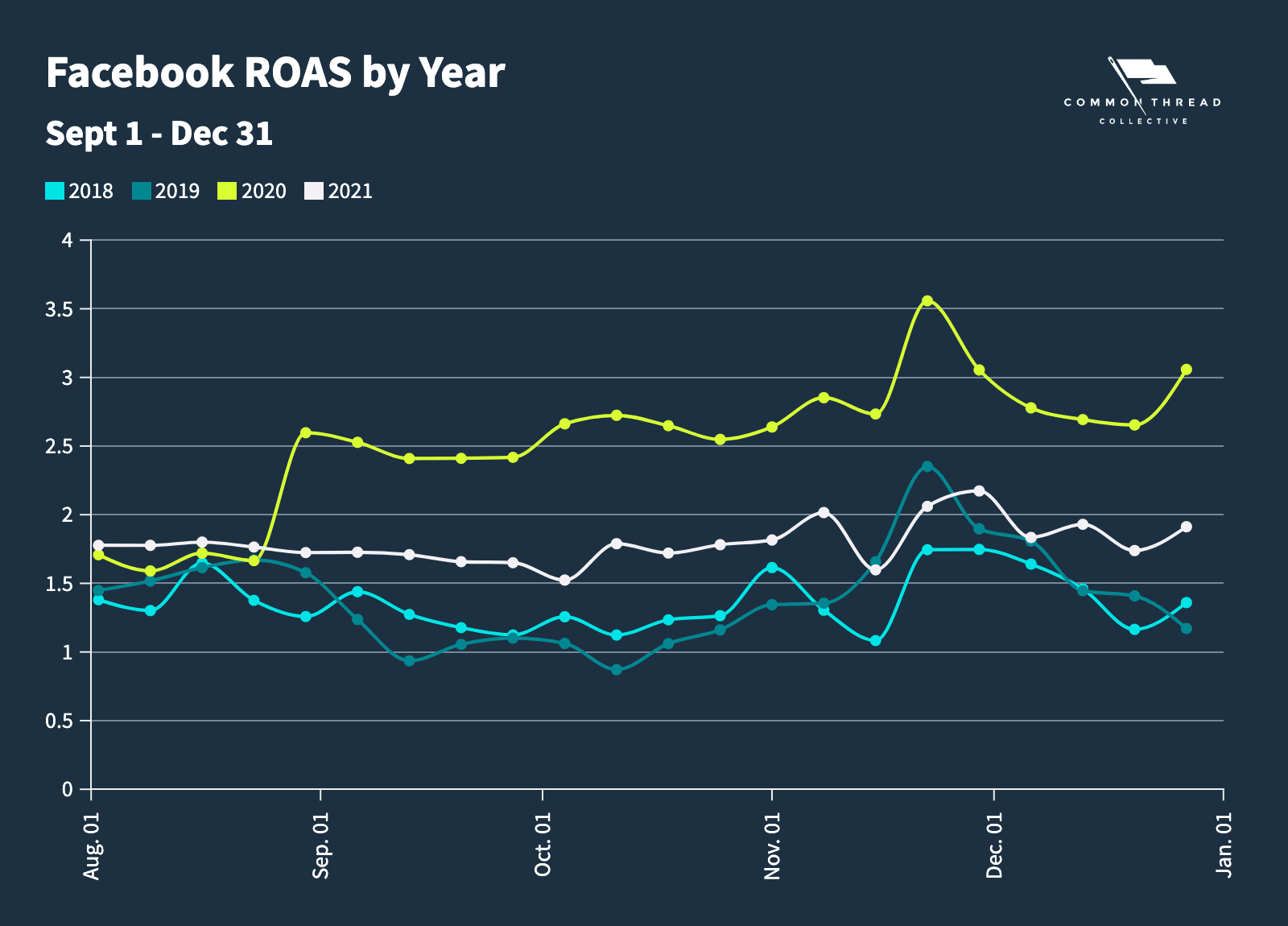

Analyzing Q4 Facebook ROAS data from the past four years, we notice a pre-BFCM performance dip due to consumers dialing back purchasing in anticipation of the holiday season. ROAS goes up as we see more conversions come November.

Though your ROAS may look bad initially, the pre-BFCM period is actually a huge opportunity to buy cheap traffic. Once Black Friday comes around, remarket to that traffic when the payoff is greatest.

Create a default dashboard that shows the metrics you should be looking at as you scale your ads for the holiday.

For the weeks leading up to BFCM, focus on:

- Outbound Click-through-Rate (CTR)

- Cost Per Outbound Click (CPC)

- Cost Per Unique Add To Cart

- Cost Per Checkout Initiated

CTR and CPC tell you how engaging your ads are — as do video views and average watch times. Cost Per Unique Adds To Cart and Checkout Initiated tell you if there’s real purchase intent behind those clicks; that the ad is driving qualified traffic.

Emphasize creative testing during this time to find ads that drive the lowest CPC and highest CTR.

Continually iterate on best-performing ad creative to find the winners ahead of Black Friday.

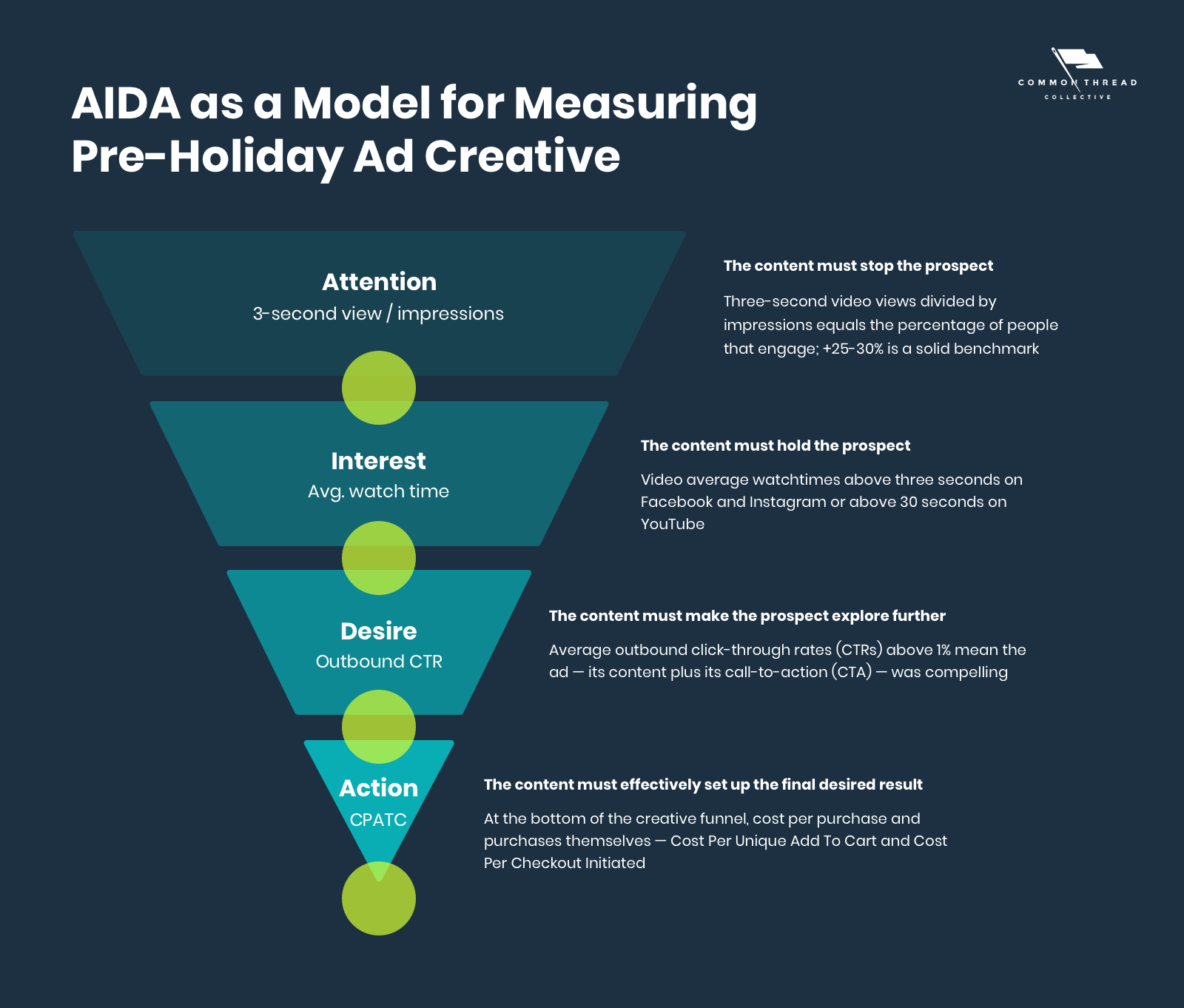

Normally, we measure creative through AIDA: Attention, Interest, Desire, and Action. Prior to the holidays, replace ROAS at the bottom of your AIDA funnel with Cost Per Unique Add To Cart and Cost Per Checkout Initiated.

This way, you have a meaningful purchase metric to measure against while taking into consideration that most people are waiting for Black Friday before they hit “Complete Order.”

During Black Friday, Cyber Monday

Focus purely on ROAS and cost per acquisition (CPA). With the high cost of traffic, disregard CPC and CPM as much as possible. Skyrocketing conversion rates will offset the price.

Speaking of which …

Conversion Rates & Lifetime Value: Timing Is Everything

At CTC, growth revolves around one equation:

(V x CR x LTV) - VC = Profit

Four variables, that’s it:

- V = How many visitors you get

- CR = How many of them convert

- LTV = How much they spend in 60-90 days

- VC = How variable costs affect product margins

For Black Friday, Cyber Monday, how do you maximize the variables? We'll say it again: conversion rates hit a high during Nov., with Dec. a close second.

Unfortunately, buying those conversions becomes exponentially more expensive during this time. And that’s why we go back to the fundamental truth of Black Friday marketing: Buy your traffic in Oct.

Get ahead of the season by planning your strategy right now (or, you know, just hire us to plan it for you.)

Jeremy Cai, CEO & Founder of Italic

Primarily relevant for brands looking to scale: you need to be realistic in looking at your business from an objective and quantitative lens.

Invest in reporting early on and develop competency around understanding and dialing in the metrics that matter for your business on a cohort basis. The sooner you do this, the better equipped you’ll be to answer how to grow your business. Don’t put this off.

For example, let’s say you sell your hero product for $100 and your contribution margin is $50, and let’s say you were acquiring early customers at $30 on FB, that’s great, double down. But once your CAC has grown to $60, it’ll be too late to course-correct. Sounds obvious, but it’s really easy to miss if you’re not keeping an eye on it constantly.

Economies of scale are purely theoretical in DTC and you need to invest in becoming a data-driven organization early on.

3. Black Friday, Cyber Monday Ecommerce Holiday Planning

After analyzing the data, insights, and trends, the question you have to answer is: “What are my business’ holiday goals?”

- Is it to be profitable?

- Is it to grow your customer base?

- Is it to prepare for the new year and gather data effectively?

Defining Your Holiday Season Success

Whether your goal is to profit, grow, or prepare — each requires you to understand the “why” behind your success metrics.

Success metrics should never be set arbitrarily (though a 4.0 ROAS does sound sexy). Instead, they should come directly from your overarching objective.

To do that, we’ve built a Holiday Offer Calculator with two tabs: (1) Cost Breakdown and (2) Profit Analysis:

Average Order Value (AOV)

Pull your AOV from last year’s holiday sale. If you don’t have data from last year, grab your evergreen AOV and adjust a bit higher if you’re projecting any sort of increase.

Chris Cantino, Founder of Club CPG (Previously Schmidt’s Naturals Dir. of Marketing)

Optimization is DTC’s strength. Big CPG relies only on guaranteed media buys and doesn’t look back. They just slap a discount on and don’t optimize.

Watch your AOV increase and be willing to raise your CAC accordingly. Know your margins and be clear on your COGS.

If your target CPA is around $15, but your AOV has gone up by 40%, can you flex on that CPA? This is different within every team.

If your company is EBITDA negative or your supply chain is backed up, your priorities may lie in actually slowing down a “too successful” campaign. Know your KPIs and make sure marketing efforts are aligned with finance and ops.

Don’t rely on your discounting to do all the work:

- Determine your target audiences

- Hone your content and variations

- Walk people naturally into your BFCM campaigns

- Prep them with content or advertising in the weeks beforehand

Marco Marandiz, Ecommerce DTC Strategist

Choose a few channels that you have disproportionate leverage on, and scale those. It makes it a lot easier for your customers to find you and doesn’t dilute your messaging across multiple distribution channels.

Every customer touchpoint matters.

From top-of-the-funnel ads through your checkout flow, consistency makes sure that your customers don’t get confused and no red flags are set off. At scale, this can have dramatic impacts on your conversion. Starting out, this gives you value props more power and clarity.

Your customers decide to buy when they see the ad, the influencer, the content. Make it easy for them to convert from these touchpoints.

Cost of Delivery (COD)

This includes any costs associated with getting your product into your customer’s hands.

You’ll need your average COGS, credit card fees, shipping costs, and your return rate.

After you enter dollar values or percentages into the green cells, your unit margin will populate — i.e., gross profit.

Next, plug in your net target (the actual amount of dollars per purchase you want to make) and that will give your customer acquisition target (CAC or CPA) as well as your target ROAS.

Marjorie Chelius, Vice President of Marketing at Mockingbird

Any seasonally-relevant “extra” you can give your customers during the holiday will provide that “little something” to make them feel valued. A simple gift upfront can go a long way toward building loyalty amongst your new and existing customers alike.

Other tactics are things like:

- Structure your holiday promotions and product releases creatively to maintain audience engagement and profitability

- Prioritize the audience segments and products that will minimize risk in terms of inventory and demand forecasting

- Stagger product and content releases to stay top-of-mind at a time when everyone’s eyes are being bid on

One of the main things that our operations team does because we’re still very lean is triaging SKUs we know are going to give us problems.

Instead of trying to get demand forecast absolutely perfect across our entire portfolio, we zone in on SKUs that either (a) have a longer lead time or (b) can’t be replenished.

Jack Meredith, VP of Marketing at Kettle & Fire

Dial your demand forecasting in for the unpredictable season to come.

When people started stockpiling from the coronavirus. We weren’t ready, sales were through the roof, and just couldn’t keep up with demand.

From that, we set up a taskforce — a brain trust — that meets once a week. We spent a full hour once a week going through each SKU, understanding what the inventory available was for DTC, Amazon, and retail.

We tried to make the best decisions on the information that we had. That information included internal metrics, trends onsite and on Amazon, and SPINS data because we’re a CPG.

Do the same for your business.

Create a task force made up of finance, operations, logistics, and marketing to understand which products will be readily available — and how to best promote them.

Holiday Offer (Discount)

In another article, we cataloged 604 offers from the top DTC and ecommerce brands. That piece holds a wealth of competitive analysis, holiday marketing ideas, and creative insights from nearly 2.4k screenshots taken during BFCM last year.

At the bottom of the Cost Breakdown tab, you can test the impact of the three most common offers:

- Discount: $-off

- Discount: %-off

- Includes free gift

Griffin Thall, CEO of Pura Vida Bracelets

At Pura Vida, we choose to stay in our own lane when it comes to Black Friday, Cyber Monday promotions. We’ve run the same promo for the past seven years, which we know works best for our brand.

Urgency, high-value prop, free gift with purchase — all of that comes together to create an offer that shoppers cannot find anywhere else on the internet.

In terms of the bigger picture, I’m seeing more brands start their BFCM special offers sooner and sooner so that might be something we adopt more this year.

But — in terms of the consistency of the offer, marketing, and urgency — we are hyper-focused on the strategy that has proven itself so well for us year over year.

Trey Sisson, Co-Founder & COO at BABOON TO THE MOON

BFCM doesn’t always have to be a deal or discount. Leverage what makes your brand special to get people excited and generate demand: new products, limited editions, etc. It’s all about setting expectations and providing value.

It’s about finding unique moments and going after them directly. The holiday season will be different this year — but our customers will still expect us to be there for them.

When it comes to messaging the moment and thinking about your tone of voice, it’s become a day-to-day exercise now. It’s more important than ever to pay attention and react quickly to what our customers are saying.

ROAS and Profit

Now that you have the Costs Breakdown tab complete, you can shift to Profit Analysis and analyze different monthly spend levels.

As you enter them, your true holiday success metrics will automatically populate, including:

- Ad revenue

- Number of transactions

- ROAS targets

- Total profit

- And per order profit

With your initial goals and metrics in hand, map a Q4 calendar by planning 3-5 campaigns centered on landers, ads, and emails:

- Pre-Holiday — Oct. Dates

- Pre-Black Friday — Early-to-mid Nov.

- Black Friday — Week of Nov. 21-27

- Cyber Monday — Nov. 28-30

- Christmas — Gifting + Shipping Cut-Off

We’ve set up a holiday calendar in Google Sheets to guide you through those five phases. If you’ve downloaded the Holiday Marketing Ecommerce Bundle, you already have it your inbox:

Just like your ecommerce business, your data and your trends are unique to you. Project your weekly spend budgets by channel to meet your holiday goal and success metrics. Then scale, scale, scale.

Babak Azad, CMO at GoodRx & Former Beachbody SVP

You have to start by considering if macro trends actually correlate with your business. Some businesses are outliers or just plain execute better than their competition and the market overall.

It’s similar to historical data. Perhaps you had a strong new product or promotion, but this year you don’t have something similar. Or perhaps, it’s the exact opposite.

Then, you have to decide what level of risk you want to take and the exposure:

- If you over-ordered a physical product, is there an expiration on it?

- How long do you think you’ll need to sell thru it, based on various scenarios?

- If you get a ton of opt-ins but not as many buyers, do you have a plan for monetization beyond BFCM?.

The bottom line: I don’t think any of the above is that different from how someone approaches their broader strategy. Only a few businesses should approach BFCM in a fundamentally different way.

It’s certainly important, but if you’re nailing the other 350+ days of the year, then I think you approach it as an opportunity to get even better results.

Chris Cantino, Founder of Club CPG (Previously Schmidt’s Naturals Dir. of Marketing)

Historical data is everything. If you’re in year one and you don’t have it, run test campaigns to isolated audiences at your planned discount rate with the goal of identifying an uptick in your conversion rate.

Or, do some lead gen by offering customers to sign up for early access to the discount as a way to gauge interest and see if you’re incentivizing enough (or too much).

Educated guesses are key, but BFCM and discount events are not “set it and forget it” moments.

You have to be ready to invest opportunistically in winning ad sets, and that can mean pulling levers — increasing and decreasing budgets on several to dozens of sets at a time. Minimum and maximum advertising budgets are okay, but static budgets are not ideal.

Peace for Your Ecommerce Holiday Marketing Strategy

One of the hardest things about being an entrepreneur is that we’re constantly being reminded of all of the things we’re failing to do.

It’s the curse of the marketer or ecommerce brand owner to live in a world of “always more to do.” At its worst, information piles on this feeling and leaves you paralyzed.

At its best … it brings freedom, light to your path, and peace.

If you’re feeling overwhelmed by Black Friday planning — or if you just want to level up your campaigns this year — CTC is here to make your wildest BFCM digital marketing dreams come true.

We have some of the best ecommerce marketing experts in the world on our team and, with hundreds of clients undergoing holiday prep at once, we’re able to offer unique insights into what’s working and what’s not.

Reach out for an audit to see how we can take your ecommerce campaigns to the next level this holiday season.

Thank you for spending thousands of words with us. We wish you a very happy holiday season with Shopify sale notifications so abundant on your phone that you have no choice but to mute them!

We won't send spam. Unsubscribe at any time.