If home is where the heart is … what happens when it also becomes the office, the school, and the gym?

Answer: Demand for all-things “home goods” spike.

Normally, high demand is a good thing. For the home furnishing industry, these past few years presented a monumental challenge — higher cost and lower margins.

How can stores within this vertical come out on top despite volatile market changes?

To plot a course to profit, we’ll be immersing ourselves in the …

Data, trends, and strategies shaping the state of ecommerce home furnishings.

- Market: Home Furnishing Industry Statistics, Data & Size

- Trends: Furniture and Decor Ecommerce Marketing

- Strategies: One Formula & Four Metrics for Growth

Part 1: Market Research

Home Furnishing Industry Statistics, Data & Growth

What is the home furnishing industry?

Home furnishings encompass a wide variety of products ranging from commercial (B2B) to consumer (B2C): indoor and outdoor furniture; appliances and entertainment; house-, kitchen-, and cookwares; bedding; floor coverings; toiletries and cleaning products; decorations, upholstery, and fabrics (home textiles).

For the purposes of this report, we’ll focus primarily on direct-to-consumer furniture, housewares, and home decor.

How big is the home furnishing market?

Currently, worldwide online revenue for furniture and appliances is $415B. By 2025, it’s projected to hit $455.4B.

Year-over-year (YoY) expansion has slowed considerably since the pandemic high. In fact, YoY between 2021–2025 looks like a grim countdown: from a 9.7% growth rate down to 4.4%.

China and the United States lead in global market value.

And it’s not by a little. It’s a landslide, both now and into the future.

However, if we look at the growth rate by percentages, an entirely different story appears. Developing countries — like Guyana, Niger, and Egypt — are expected to grow exponentially.

This disparity is likely due to three factors.

First, an emerging middle class. Second, improved logistics and shipping infrastructures. Third, the continued globalization of free-trade agreements.

North America mirrors global totals, though at a smaller scale. Projections are expected to reach $98.3B by 2025. YoY changes show the familiar downward trend.

As for the e-retail economy, home furnishing took a sliver of the cake at only 17.1% in 2022 and it’s expected to slightly decrease to 15.7% by 2025. Currently, the industry nationally is slowly increasing and expected to reach $87 billion by 2025.

Does ‘slow but steady’ domestic ecommerce make for a bleak outlook? No.

The share of online home furnishing purchases continue to rise, inching up into the 30% mark from 2023 on.

Plus, the United States has a consistent demand for home furnishing goods. Why? Three reasons …

- Larger homes and apartments

- Advanced shipping infrastructure

- Greater demand for property purchases and larger living spaces

Two more bright spots: fragmented competition and low saturation.

At the enterprise level, 11 brands currently command 55% of the market —mostly in retail. In comparison, only two brands control ~40% of the pet industry.

Home good’s fragmentation speaks directly to lack of brand loyalty and, therefore, rich opportunity for disruption.

On the DTC front, it’s essentially inverted: from a cluttered competitive landscape … to wide open (relatively speaking).

Semisupervised’s study of 1,111 DTC brands identified 164 in the home space: 14.8% of the total. It also scored each category’s saturation level by dividing the number of startups by market size (*100).

Below is a sample of the study’s findings, which placed “Home & Garden” firmly in the least-saturated category. Especially when compared to industries like ecommerce beauty and online fashion.

Likewise, of the 464 companies tracked on 2PM, Inc.’s DTC Power List, 67 are in the housewares or home furnishings category. That’s 14.4% — nearly identical to Semisupervised 14.8%.

Top 25 Direct-to-Consumer Home Goods

The opportunities are profound with no legacy leader and minimal interference from upstarts.

Even better, low barriers of entry and the absence of a major retail monopoly makes this industry perfect for DTC brands.

Want weekly data updates on Home Goods delivered to your inbox?

From store CAC to Facebook ROAS, the DTC Index contains charts tracking year-over-year data points from all parts of the funnel.

Part 2: Market Trends

Home Furnishing & Decor Ecommerce Marketing

What furniture and decor styles are trending in 2023?

In efforts to support remote working, home-office upgrades will continue to lead the way: desks, chairs, storage, and professional decor. This comes with an increased desire for goods to fill multi-purpose spaces and separate personal from professional.

Other emerging movements include vibrant wallpaper, indoor plants, bidets, smart lighting, and grandmillennial chic.

Here, we’re discussing the top-three ecommerce trends — home offices, livable luxury, and smart home appliances.

As remote work continues to dominate many sectors, companies in the home furnishing industry, like Article, have experienced a 200% increase in growth.

How are retailers forecasting 2023?

According to Furniture Today, “We forecast demand to remain at 10% to 50% below the past two years and basically more in line with 2019 numbers.”

“We’re forecasting a little light now. It’s easy to get goods. It wasn’t easy in 2020-2021.”

On average, the home furnishing industry relies heavily on consumer income, new home purchases, and remodeling efforts. Millennials currently make up the majority of active consumers and won’t change in the near future.

1. New Home + Office, Who Dis?

Remote work has given more people than ever the freedom to explore different locations.

A new home doesn’t just include buying a new house. It encompasses remodeling, redesigning, and redecorating to accommodate new lifestyles.

The popularity of home offices ushers in the demand to adequately furnish these spaces.

At the same time, work-from-home has given birth to a crying need to separate personal-from-professional spaces and a far higher usage rate of consumable home goods: staples like toiletries, cleaning supplies, and various paper products.

For instance, where Brandless stumbled as a DTC alternative to discount stores, Grove Collaborations has thrived. How?

By majoring on (1) sustainability, (2) email-centered customer acquisition, and (3) increasing AOV through automatic cart building:

2. Comfort … But Make It Luxurious

Gone are the days where luxury home items are synonymous with the rich. The look, feel, and even the cost of luxury home furnishings are pivoting.

In the past, precious metals and expensively sourced materials were the go-tos for larger items like beds and dressers. Cozy spaces were more about being “Instagramable” versus actual comfort.

These trends have dramatically shifted to buying smaller items as statement pieces, comfortable spaces that look and feel like luxury, and larger items that are eco-friendly.

Think house plants, responsibly crafted bedroom furniture, ethically sourced rugs.

Likewise, the online shopping experience itself should be comfortable. While we’ll assemble a mansion of examples in Part 3, on this trend, Joybird’s ad-to-Messenger quiz towers as a monument to ease-meets-opulence.

3. Kitchenware & Appliances That Have Brains

Kitchenware and appliances have not been immune to the radical changes of the past five years. The pandemic brought with it an increased demand for cookware and bakeware that rivaled the 1950s.

Consumers are looking to add more smart appliances and all-in-one cookware to their kitchens to make simple tasks simpler.

Brands like Suvie have tapped into innovation. As a truly all-in-one system, its Kitchen Robot has features that allow multiple cooking tasks to be completed simultaneously.

The best super-techy feature of all is the use of smart recipes where the robot receives cooking instructions by scanning smart recipe cards.

Part 3: Growth Strategy

One Formula & Four Metrics for Ecommerce Home Goods Marketing

How do I market my home furnishing business to grow profitably?

Strategies for marketing begin with top of the funnel efforts like media buying and ends with a system for accelerating customer lifetime value.

Home goods purchases are very personal and require a lot of effort to be put into visuals, content, and long-term support. In short, mirroring furniture stores without ever stepping inside.

Sales growth for online retailers depends on understanding and then optimizing the only four levers that truly matter.

Previously, ecommerce options were widely available but limited by customer questions like:

- What will this piece look like at home?

- How can this company help me enjoy my purchase?

- How long and how much will it cost to ship or make a return?

This forces retailers to circle back to the customer’s experience and how that is translated to the internet. Even as the pandemic nears its end, the floodgates of ecommerce have been opened and there’s no going back.

So, what options are available? One formula and four metrics …

- Attract visitors who are primed for purchase (V)

- Convert them using the latest technology (CR)

- Drive profit beyond the first purchase (LTV)

- Lower costs at every opportunity (VC)

It's the cheat code. See it in action …

Attract More & Better Visitors

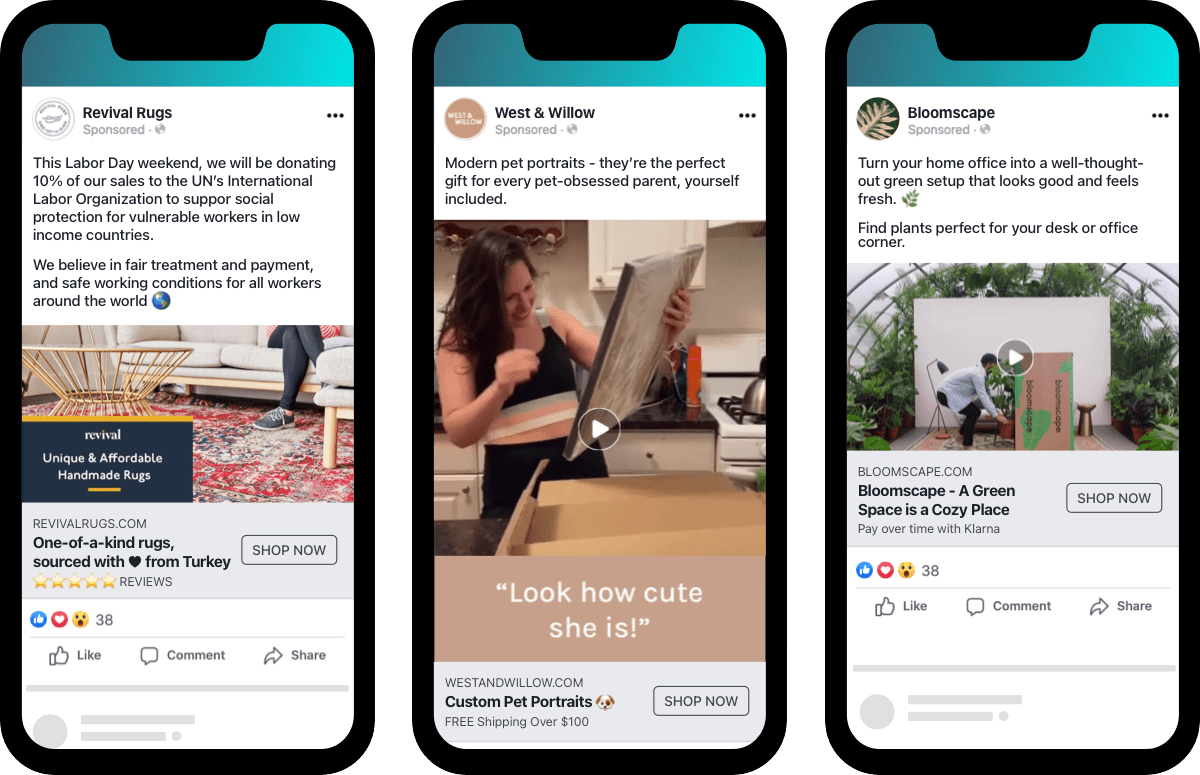

Paid Social

Consumers want to “feel” the product before they can actually “feel” the product. Although, feel doesn’t necessarily mean touch.

In the cut-throat DTC mattress industry, Purple established itself through a savvy combination of science-meets-humor. Strong branding rooted in that throughline connected it to customers.

For instance, its now classic “Raw Egg Test” not only led the brand’s accounts for years, it also spawned an army of user-generated content and “Goldilocks” continues as a character today:

Still, that kind of high-concept storytelling doesn’t negate direct-response Facebook advertising. Far more dominant in Purple’s current account are ads about the product, the price, and seasonal promotions:

Bringing those sides together — storytelling with direct-response — is where paid social comes alive.

Organize your efforts around a consolidated account structure built to scale. Though ad spend and number of SKUs will require expansion, three cornerstone campaign types should function as a blueprint:

- Full Funnel: Prospecting + Remarketing

- Dynamic Ad Broad Audience: Prospecting

- Dynamic Product Ads: Remarketing Product Catalog

First: For full-funnel campaigns, think through the angles that will shape your creative Facebook ads. What events trigger customers to buy? For home goods, it’s likely one of three moments:

- Making an old space new

- Making a new space your own

- Making a personal space professional

Then, identify the value propositions to highlight during those stages. Using the three moments above, the values could be …

Second: For prospecting, divide your campaigns into customer categories and lean hard on Dynamic Ads for Broad Audiences (DABA).

Essentially, DABAs are a new-customer version of Dynamic Product Ads (DPA). They allow you to target a prospecting audience to reach people who have expressed an interest in the particular product … even if they’ve never visited your website.

The best way to do this is to categorizing your products by customer profile as it relates to usage:

- Indoor vs outdoor

- Male vs female

- Personal vs professional

- Etc.

For ad creative, identify your most popular SKUs by:

- First purchase

- Repeat purchases

- Related or similar purchases

Third: Leverage at least two types of Facebook retargeting campaigns. (1) Special offers or creative strategies based on your most successful full-funnel value propositions; (2) evergreen DPAs driven by Commerce Manager’s direct connection to your store’s products.

Paid Search

To catch consumers who may researching, Purple dominates ecommerce Google Ads — as well as Google Shopping — for keywords like “purple” and anything “mattress” related:

Unlike social, search’s divide isn’t prospecting versus remarketing. It’s branded versus categorical.

Branded search (just like it sounds) means bidding on brand-name terms or owned-product keywords:

Categorical search aims at terms related to your products. For a pet-centric home decor brand like West & Willow (shown above) this would include search phrases like:

- pet portrait

- pet pictures

- dog painting custom

- pet canvas art

- puppy portrait

- draw my dog

Here your account structure should be built around budget ranges that our Paid Search team likes to call the …

Search Engine Marketing Order of Operations

Brand Search: <10%

Limit to less than 10-15% of total account spend; brand search campaigns should have the highest ROAS in your account.

Google Shopping: >60%

Target more than 60% of total account spend. Clean, well-optimized data feeds and consistent product approvals in Google Merchant are the secret to success.

Non-Brand Search: 18%

Use Dynamic Search Ads (DSA) targeting combined with Smart Bidding; search ads often have a lower return than Shopping due to higher CPCs. Aim for less than 20%.

Video (YouTube): 8%

Begin by remarketing on YouTube then turn toward prospecting; mix the two approaches at around 8% of your budget.

Smart Display and Discovery: 5%

Create multiple retargeting touch points within 24-72 hours after someone visits, views products, adds to cart, etc. Display Network should hang around 3% and Discovery at 2%.

Smash Conversion Rates

On average, home furnishings stores makes up about 84% of purchases in the United States. Shopping is a personal experience, requiring three of the five senses, simultaneously — sight, touch, and, in some cases, smell.

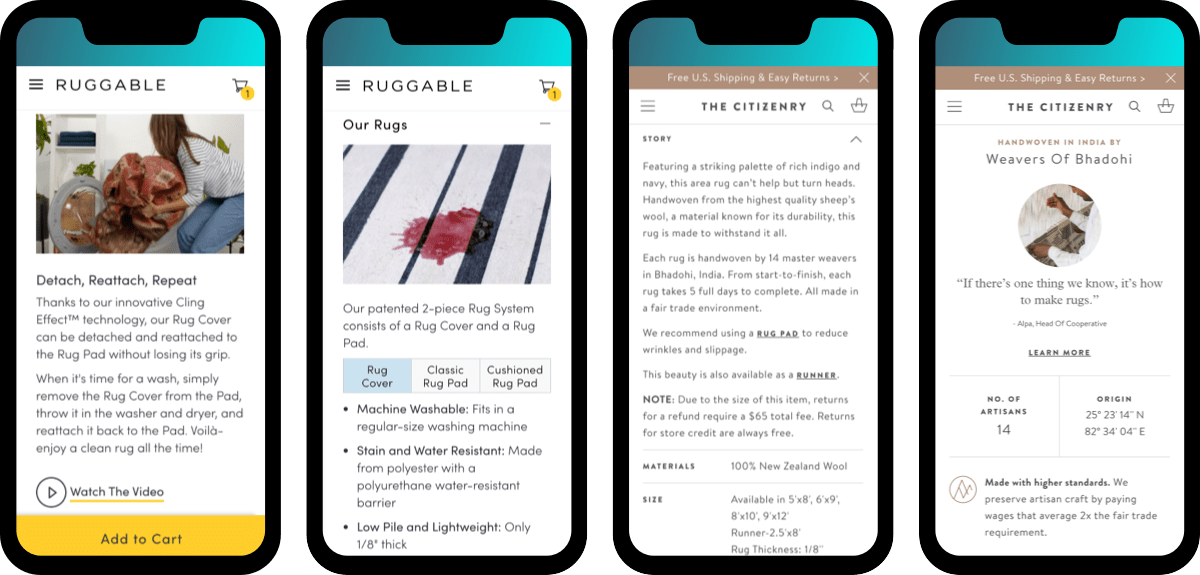

Increasing conversion rates centers on a variety of tactics that aim to replicate physical elements through onsite merchandising.

Augmented Reality

Perhaps the most-promising bridge between the real and digital worlds — between offline retail and online ecommerce — is augmented reality.

Apps like IKEA Place allows customers to virtually place true-to-scale 3D models in their home to visualize future purchases. Sadly, standalone apps can be cost prohibitive, especially for growing companies.

Thankfully, Shopify has developed its own native augmented reality solution. Not surprisingly, many of the early adopters have been from the home goods industry:

Even less spendy — and a lighter technical lift — is adding interactive elements to product pages or taking advantage of mobile shoppers’ phones to “augment” still images:

Onsite Search & Navigation

Unlike retail, where consumers have been conditioned to stroll through multi-floor warehouses (mega department stores like IKEA or Costco), too many online options can be a conversion killer.

How does anyone shop from brands like Wayfair? 14K results for outdoor dining sets?! I’ll be dead by the time I find one I like.

— Mandi Moshay (@MandiMoshay) May 2, 2021

To solve this issue, onsite search and intuitive navigation can help. According to a study by Econsultancy, 15% of consumers who use onsite search account for 45% of ecommerce revenue.

Article, for example, places its search bar front and center. It mimics other search engines with autocomplete, autocorrect, suggested terms, and even minimal merchandising as you type:

Bloomscape, on the other hand, kicks off its search engine with preloaded suggestions and features a dramatically simplified, four-part navigation in its header.

Why these differences?

Furniture shoppers come with intent. You know what type, color, or room you’re trying to fill. For plant shoppers, assuming that kind of knowledge could be a problem.

Newbies usually don’t know where to start. That same problem is also why, as an added value to customers, the site is packed with plant care guides to help enthusiasts at all levels.

Product Pages

Next, product page design is critical for increasing conversion rates. The more information that is readily available prior to and at the time of purchase, the better.

- Prominently displayed customer reviews

- Videos that show details or benefits in action

- Related products, recommendations, and bundles

- Compelling descriptions, instructions, and storytelling

Let’s look at each of those ingredients …

Check Out, Cart & AOV

Increasing conversion rates can also be done in conjunction with increasing average order value (AOV).

No one does this with more elegant sophistication than Grove.

Grove’s digital marketing plan centers on collecting email addresses and prebuilt bundles. Once an account has been created, the site automatically builds custom carts … even for single-item selections.

Many of the product pages shown above contain bundles as well as recommended products.

Bloomscape, however, layers three approaches into one:

- “You Might Also Need” immediately before its add to cart button

- “People Also Browsed” further down the product page

- “People Also Bought” embedded in the cart

During its holiday campaign last year, Brooklinen took these tactics to an entirely new level.

First, it led with a free gift at $150. Second, it integrated a percent-off discount tier — 10%, 15%, and 20% — into its cart.

Then, the brand prompted shoppers with exact dollar-amounts and suggested products to hit the next savings threshold.

One pressing issue is that most consumers are still apprehensive about making big ticket purchases via mobile, so they’ll use their cell phones for research and move to a desktop to make the final purchase.

To alleviate sticker shock, offer quick and easy payment plans like Klarna, Affirm, or Afterpay.

Alternatively, in place of high AOV products, consider low-price-point funnels to win new customers. Chasing Paper’s Sample Packs shine on this front but don’t assume larger SKUs can’t be modified as well.

Both Parachute and Purple have adapted this idea. The former sells $3 fabric swatches with free shipping and the latter, a $3 Squishy with this amazing copy to accompany it:

“The best part? You decide its purpose. Use it as a resting place for your phone. A doll bed. A stress reliever. The Squishy’s potential is only limited by your imagination.”

Up Your Lifetime Value, Faster

Big furniture purchases aren’t made often and that poses a huge lifetime value issue for retailers. How can you maintain profitability if a couch or bed is only purchased once or twice in a lifetime?

Subscriptions

Smaller home items can increase LTV by allowing customers to consistently purchase lower priced items that they love. In many cases, categories like cleaning, decor, and plants are ready-made for this approach.

Standalone items, like candles, are equally ripe. For example, ForvrMood offers subscriptions that ship new candles to customers quarterly.

Getting creative and cost-efficient, Art Crate ships personalized art pieces to customers on a monthly basis for only $29 — a far lower price point than normal online artwork, sustained by repeat purchases.

As Time Magazine’s “Best Invention” of 2020, Gardyn has capitalized on numerous trends at once — mixing grow-at-home DTC gardens with an app subscription that (at scale) is pure margin:

Lastly, subscription doesn’t necessarily mean products.

Uncommon Goods’ paid-membership program unlocks numerous benefits, makes customers want to come back, and is promoted to new shoppers through email — which is where we’ll turn next.

Email Marketing & SMS

Finally, leveraging email marketing and direct messaging — texts or DMs via social platforms — will always be go-tos for increasing LTV.

What does a powerful retention program look like? As a guide to ecommerce email marketing, there are at least 13 automation types (flows) you should prioritize:

Let’s examine a few examples from the highest priority automations …

Welcome Series: 3-5 Emails

Kick off by delivering the sign-up incentive immediately. Did you tell them they’d get a percentage-off coupon? Send it. Was it free shipping? Ship it. How about a free introductory sample or a giveaway? Make sure it hits their inbox.

Only after living up to the expectations you established should you move on to showcase products or categories. Show off your brand voice and ethos — vibrant visuals, causes you support, and copywriting that breathes personality.

Finally, round it out with custom content either through segmentation or with dynamic blocks separating purchasers from non-purchasers.

Cart & Checkout Abandon: 3 Emails Each

Though often used synonymously, there are key differences between cart abandonment versus checkout.

When someone leaves a cart, it’s difficult to know why. Did they need to do more research? Was it the price? Maybe shipping times? Or, quite possibly, they just got distracted?

Your emails have to play the spread … addressing as many of those issues as possible, getting as personal as possible, and delaying discounts for as long as possible.

For checkout abandonment, it’s predominantly the price.

We know this because the final step in nearly all checkouts is entering payment information and clicking confirm. Here it’s fine to go straight to discounting.

However you decide to address these two flows, keep it simple! Focus directly and only on the exact products your would-be customer left behind.

Re-Engagement: 3 Emails

Target subscribers who haven’t opened or clicked within a recent time frame (90-180 days) to attempt reactivation.

Entice them to return by combining three elements:

- A meaningful discount of at least 15% or more

- Fun and friendly copy that speaks to the moment

- Useful guides and CTAs to help them shop, decide, and get inspired

Campaigns & Newsletters

Lastly, ongoing campaigns for special events and newsletters that provide a healthy mix of products and content are critical to keeping your list engaged.

In the case of events, naturally you should lean into traditional shopping holidays. But don’t let a two-peaks calendar — Black Friday, Cyber Monday plus one additional holiday — limit you.

Instead, carve out an ecommerce marketing calendar with at least four peaks:

As for your newsletters, above everything, provide value to your subscribers by educating, entertaining, and (only after those two parts have set the foundation) selling:

Optimize Variable Costs

Variable costs are expenses tied directly to order volume: COGS, platform and payment processors, pick-and-pack fees, fulfillment, shipping, etc. Fixed costs, in contrast, operate independent of sales volume: rent, utilities, payroll, etc.

How do you measure and optimize variable costs?

There are plenty of ways, but we strongly recommend you follow a four-quarter accounting matrix. Each represents a portion of your revenue that signals the health of that component as well as areas of opportunity:

- Cost of delivery

- Customer acquisition costs (CAC)

- Operating expenses (OPEX)

- Profit

Ideally, aim at 25% of revenue going to each of these categories.

One of the biggest issues that online furniture retailers face is shipping costs. With China being the world’s top furniture manufacturer, shipping can dramatically increase the price of goods. Even domestic fulfillment is pricey and can make online shopping a hassle.

This eats away at your margins at both ends: first, getting it to you; second, getting it to your customers.

One solution is to include shipping costs in the price. Most consumers are prepared to pay for shipping but absorbing it in the price makes for better optics.

Another is to create free or discounted shipping thresholds. Mainstream furniture retailers, like WayFair, offer shipping on all orders that exceed $35. Adjust your own as needed.

The DIY assembly route can also help retailers save. Companies like Elephant in a Box use high-quality ingenuity in its design to ship products quickly and cheaply.

Next, for customer acquisition costs, anchor your approach to growth in a clear understanding of your business’ unit economics: What does it take to get one click (V), acquire a single customer (CR), retain that customer (LTV), and deliver one product (VC)?

A line-item breakdown of everything that goes into getting what you sell into the hands of your customers should be your starting point. With that, you can then set profitable spend, budget, and ad costs.

Finally, frame your overall strategy as a three-layered revenue “cake” with your most stable sources as the base.

- Existing customers as the foundation

- Owned audiences in the middle

- Paid acquisition at the top

Volatility and variability mount as you move up the cake. That means revenue becomes more unpredictable. The goal is to focus on factors you can control — not only for healthy economics, but also for ecommerce demand forecasting.

What the Future Holds for the Home Furniture Market and Online Decor Industry

The coming years show slow and steady growth for the home furnishing industry. But growth isn’t the focal point — profit is.

Where can you find more customers? Why would they convert on your site instead of a rival (whether online or off)? What products will they value the most? How can you make them stay?

These are all questions that every retailer should be asking. Not to mention keeping a pulse on new distribution channels, supply chain advancements, and other company profiles.

Evolving in such a way that bridges the gap between ecommerce and in-store retail without forfeiting the customer experience is by far the most effective way to claim your stake.

For future references, it seems to be the only way.

We won't send spam. Unsubscribe at any time.

Melissa Rosen is the Director of Marketing and Content at Common Thread Collective. Based in San Diego, California, she has spent the last decade exploring how to create engaging content that inspires, teaches, and entertains. Melissa can be found on Twitter and LinkedIn talking all things content, marketing, and ecommerce.