The demon goes by many names: ecommerce “reckoning,” exit “purgatory,” Amazon “arbitrage,” the “customer acquisition pricing parade.”

Each a stone at the entrance of what was and no longer shall be.

Roughly 15 years ago, the first disciples of DTC began spreading the word of lower prices, higher margins, and one-to-one customer relationships. The ecommerce trends were simple …

- Launch with one or minimal flagship products

- Evangelize through early adopters

- Scale via paid media

Amid low competition and even lower ad costs, early converts carved a path through performance and emerged triumphant.

Today, that playbook is faltering. Or is it?

“And he asked him, ‘What is thy name?’ And he answered, saying, ‘My name is Legion: for we are many.’” — Mark 5:9

At the opposite extreme, ecommerce predictions herald the “retail apocalypse” and rebirth of online shopping as a technological experience — fueled by augmented reality (AR), artificial intelligence (AI), virtual reality (VR), and voice-enabled search.

Nonsense.

What the data, owners, and leaders prove isn’t that the online golden age is over. Nor that retail is dying. Instead, they point toward …

10 ecommerce trends for 2022 and the future of DTC growth:

- Direct-to-Consumer Marketing Overtakes DNVB Operations

- Retail Rebounds Post-Pandemic & Omni-Channel Surges

- Facebook Remains on the Social Media (Acquisition) Throne

- Retention Accelerates Because You Can’t Wait a Lifetime for LTV

- Ecommerce Businesses Turn to Profits & One ‘Future’ Formula

- Online Shopping Compounds Gains with AOV Optimization

- Multi-Channel Unites Demand Generation & Demand Capture

- Creative Content Anchors Itself in the Funnel’s Analytics

- SMS > Social Commerce for Intimate Customer Experience

- International Ecommerce Almost Becomes the New Normal

1. Direct-to-Consumer Marketing Overtakes DNVB Operations

To overcome the struggles of scale, traditional DNVBs are moving beyond DTC as an operational model. Instead, “direct” will increasingly become ethos: an approach to marketing and retention steeped in the value and feel of one-to-one relationships but no longer governed by manufacturing and distribution ownership.

The move cuts both ways: from the bottom-up (DTC to wholesale) and from the top-down (legacy to DTC).

The New York Times’ excerpt — “They Changed the Way You Buy Your Basics” — is but one in a long line of mainstream features illuminating commerce’s revolution.

Coupled with Vogue’s “These Are the 50 Digitally Native Brands You’ll See Everywhere” and annual benchmark reports from iab’s Disruptor Brands and Traub’s New Davids, the list of upstarts turned staples continues to mount.

What unites these disparate verticals isn’t only direct sales channels but also a focus on “brand equity” and “brand purpose.” The value of a brand as beheld by customers. Owning their relationships, DNVBs run on value, elevating people and products over price and place.

For the uninitiated, DNVB stands for “digitally native” — born online — and “vertical” — in-house production, distribution, and sales. DTC, on the other hand, refers strictly to the sales channel itself: direct from company to consumer.

There’s just one problem … beyond a few notable outliers, DNVB doesn’t scale. Nor does DTC. And the future demands embracing that reality.

As evidence of scale’s adversity, many of DNVB’s founding parents — names like Bonobos, Casper, and Happy Socks — have entered wholesale either through acquisition or alliance. Traditional outlets like Walmart, Target, Macy’s, and Amazon are happy to serve as the middlemen “vertical” once cut out.

The turn to owned retail may preserve some purists — e.g., UNTUCKit, All Birds, and Rhone — but over the long-haul:

Rather than an operational model, DNVB and DTC are pivoting to ethos …

di·rect-to-con·süm·er Ethos

An approach to marketing and retention steeped in the value and feel of one-to-one relationships but no longer governed by manufacturing and distribution ownership.

Ironically, this pivot works from the top-down (legacy wholesalers entering DTC) as well as the bottom-up (DTC entering wholesale).

Nike is perhaps the supreme example of the first. Operationally, it’s aggressively pursued ecommerce as a direct sales channel.

Nike’s advertising, social content, and product development embody the best of DTC’s ethos: emotionally charged storytelling that enters its audience’s world without presenting itself as the center of their world. Nowhere does that ethos shine brighter than the company’s commitment to Black Lives Matter and holidays like Juneteenth.

Likewise, other incumbents are entering the fray.

With over 1,500 employees and several hundred million dollars in annual revenue, Igloo Products Corp launched its DTC ecommerce arm in 2017. It 3x’d ecommerce revenue after year one and actually increased its growth every year since.

“As a traditional wholesaler, we made the decision to build the DTC business as our consumer demand told us to, the economics are in our favor, and the data collected is invaluable,” says Brian Garofalow, VP of Marketing and Ecommerce at Igloo.

“In the last year, we were able to simultaneously increase traffic by 2.4x while lowering acquisition cost by over 20%.

The net result is operating a profitable business unit, having a closer relationship to consumers, understanding what triggers purchase behavior from which cohorts, and realizing a long term plan for building a more profitable DTC business while also gaining insights that are incredibly valuable for new product development and leading indicators to wholesale customer sell-through.”

What then of DTC brands themselves? Particularly medium-to-large online retailers navigating scale in the next five-to-ten years?

“As long as you’re selective, wholesale gives you a unique opportunity for awareness and visibility,” notes Taylor Sicard, co-founder of WIN Brands Group.

Home to seven DTC companies with a compounded annual growth rate of over 800%, WIN Brands is particular about which partners can sell its products online. If “strategic opportunities” exist, it grants limited rights. With most, it only allows brick and mortar stores.

In Sicard’s words: “When somebody walks into Nordstrom, Bloomingdales, or Target and they see your product on an end cap or a display, it’s cast in a familiar, positive light. It’s a subconscious thing. That way, when they see an online ad later, everything comes together.”

Somewhat similarly, WIN Brands treats Amazon like a wholesale channel, balancing acquisition costs and discoverability with the “black box” nature of Amazon’s data.

Homesick Candles, for instance, went from not being on Amazon two years ago to becoming the number one scented candle company and the number two candle brand. In a crowded industry like home goods, that accomplishment is all the more powerful.

“The future of DTC is omni-channel, only selling through one channel limits your opportunity for both brand visibility and revenue generation. If that means leaving behind ‘direct’ control over distribution, fine. There’s nothing sacred about the definition of an acronym.

“It can’t mean leaving behind a direct connection to your customers emotionally.”

“People buy DTC (even if they’ve never heard of it) because of the product first. They come back only when that product feels bigger than a product. It’s always going to be about relationships.”

2. Retail Rebounds Post-Pandemic & Omni-Channel Surges

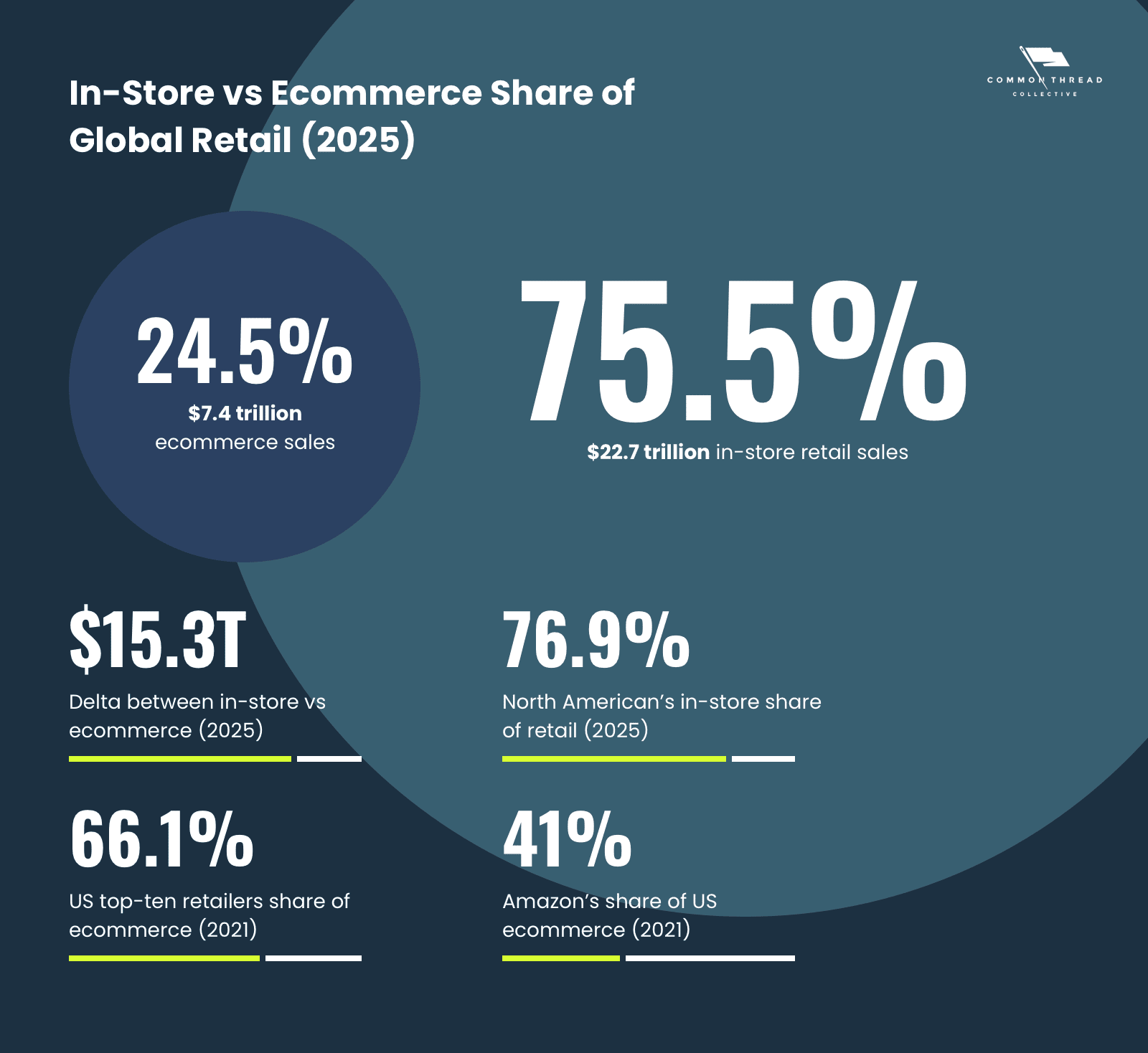

New growth aside, in-store retail towers above online sales by over $15.21 trillion. Although coronavirus accelerated ecommerce adoption, brick-and-mortar’s rebound has been swift.

Turns out, people still like their products in places.

For scaling brands, the path forward hinges on crossing the online-to-offline divide.

COVID-19 descended on retail like locusts. Already a waning harvest, the “retail apocalypse” bankruptcy count now sits at 135 once-landmark chains, gone. Legacy manufacturing market share is flat. In-store sales for consumer packaged goods are declining. Malls, decimated.

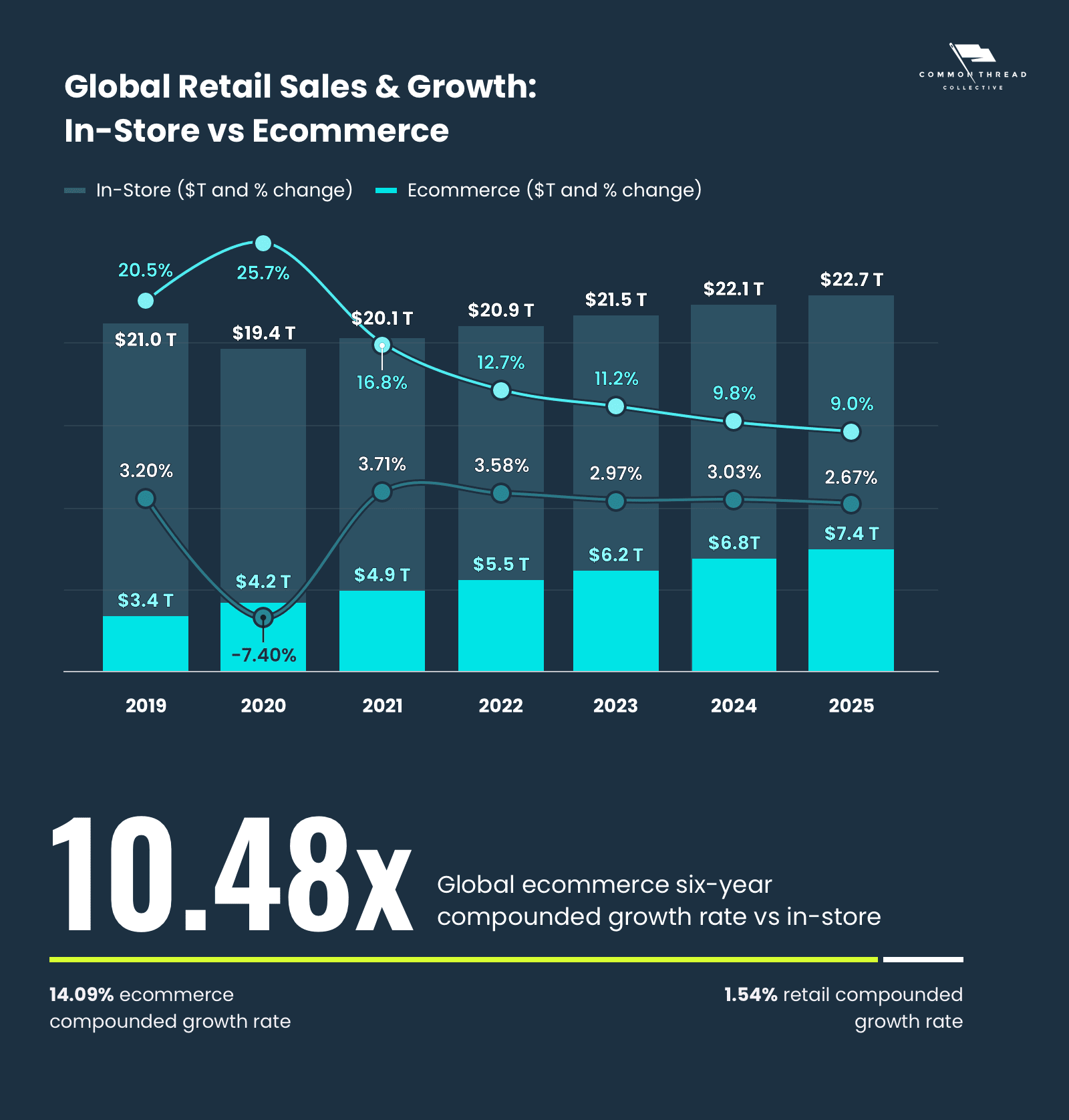

In their place, ecommerce has devoured the lion’s share of new gains. Its six-year compounded growth rate poised to outpace in-store retail by over 10x.

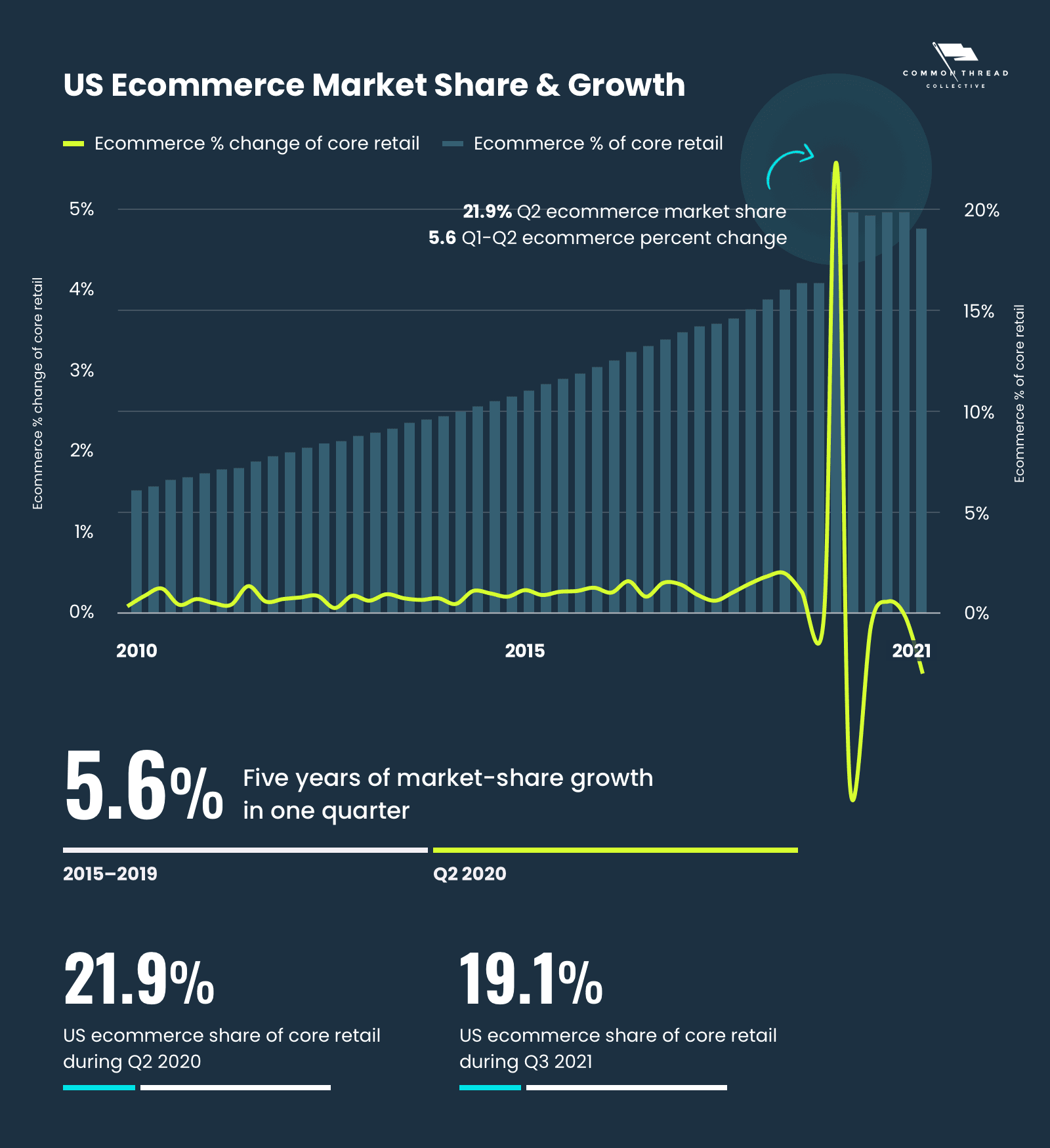

In the US, coronavirus catapulted five years of growth into a single quarter.

Data from the US Census Bureau put ecommerce’s share of core retail at 21.9% in Q2 of 2020 up from 16.3% in Q1 — an increase of 5.6 percentage points compared to a cumulative 5.6 for the five previous years.

Though slightly down during 2021 (19.6%), COVID’s push towards online shopping marked a lasting step-change in consumer behavior.

At the same time, retail looms above online sales by over $15 trillion.

Projections put in-store purchases at 75.5% of worldwide retail sales by 2025; in North America, 76.9%. Of US ecommerce’s 2021 share, the top-ten online retailers accounted for 66.1% (vs. 60% in 2020); Amazon, a whopping 41% — up 3% YoY.

What are we supposed to do with data that appears locked in conflict? Make peace.

Yes, a step-change has occurred. Yes, people still like their products in places. Both are equally true. And both are required to move forward.

As models, consider the cross-channel rise of Schmidt’s Naturals and Rhone Apparel.

“It all started at farmers markets and street festivals around Portland,” says Jaime Schmidt, founder and author of Supermaker. “Back then, I was selling deodorant in glass jars. People would stop in their tracks and say, ‘Whoa, deodorant in a jar?’ I’d say, ‘Yes, and here’s why you need to try it.’”

Those personalized experiences — coupled with growing customer requests in-store — soon led to wholesale through local “mom and pop” retailers, food co-ops, and natural groceries, like New Seasons and Whole Foods.

“Showing strong sales numbers in natural grocery,” notes Schmidt, “was imperative for consideration in traditional pharmacy and grocery.” Last on the list — big box: including Target (where Schmidt was only the second natural deodorant stocked), Walmart, and then Costco.

“DTC was an active channel from the beginning, but we really kicked it into gear a few years in when we began putting money into Google and Facebook ads. We turned on Amazon as well,” explains Schmidt.

“That DTC strategy was imperative for revenue and recognition. It became more challenging to maintain high ecommerce website sales as distribution spread. Still, we were strategic and successful in maintaining strong DTC sales right alongside high numbers in retail.”

In comparison, Rhone’s expansion has focused on an intensifying push into retail. It owns four locations, including one in Hudson Yards where it’s the second-highest, sales-per-square-foot apparel store.

“We are pretty proud about this given we are a men brand and are going toe-to-toe with very established dual-gender brands,” says Nate Checketts, Rhone’s co-founder and CEO. “While transactions continue to scale and tilt towards seamless digital environments, the impetus for transactions are influenced by IRL offline.”

What does that “impetus for transactions” look like? Rhone’s ideal shoppers — as is the case for many ecommerce fashion brands — make decisions based on three factors: (1) what they currently own and love, (2) what friends or family own and talk about, and (3) in-person, in-store interactions.

As for determining omni-channel success:

“We measure every store based on traditional four-wall economics as well as a more updated ‘full impact’ model that includes a halo effect for the store. While the halo effect can vary based on location and have various sensitivities, we believe strongly in the unit economics of the store.

“Fundamental retail economics haven’t changed — location, in-store teams, and lastly layout-plus-displays. The halo can give you stronger confidence to lean into retail as a channel and understand how else to use the store beyond just as a store.”

3. Facebook Remains on the Social Media (Acquisition) Throne

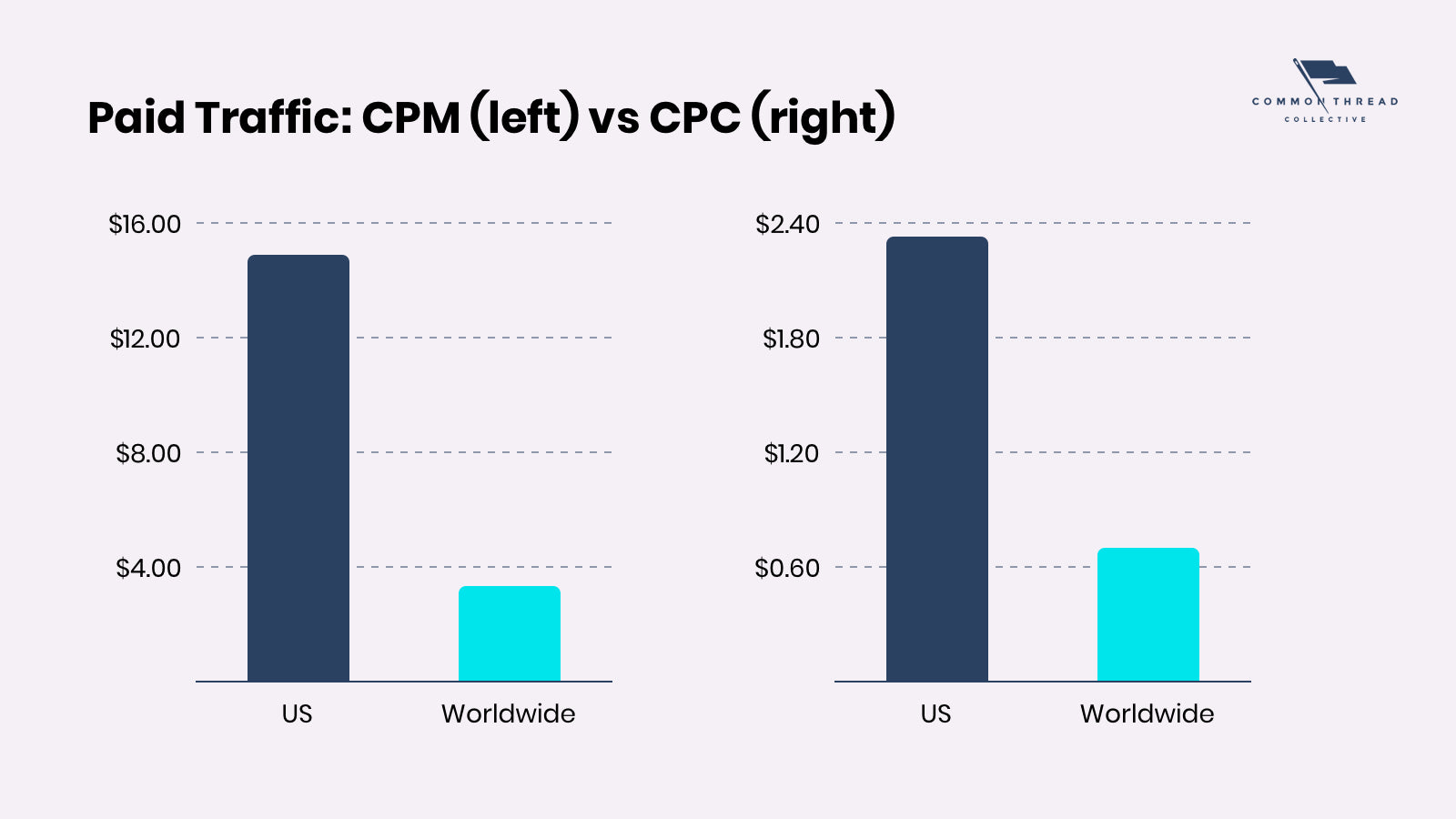

Over-indexed on Facebook and awash in rising costs, diversification has become DTC’s buzzword du jour. What owners and marketers typically mean is: “Let’s find a channel that generates the same or better returns than Facebook and Instagram at the same or better volume.”

Such channels simply don’t exist. The answer? Experimentation and overlap with new channels while maintaining Facebook as the primary driver executed beneath a single banner …

Whether through TikTok, podcasts, or direct mail, diversification is an alluring proposition.

Better still when you weigh not only costs and ROAS, but saturation.

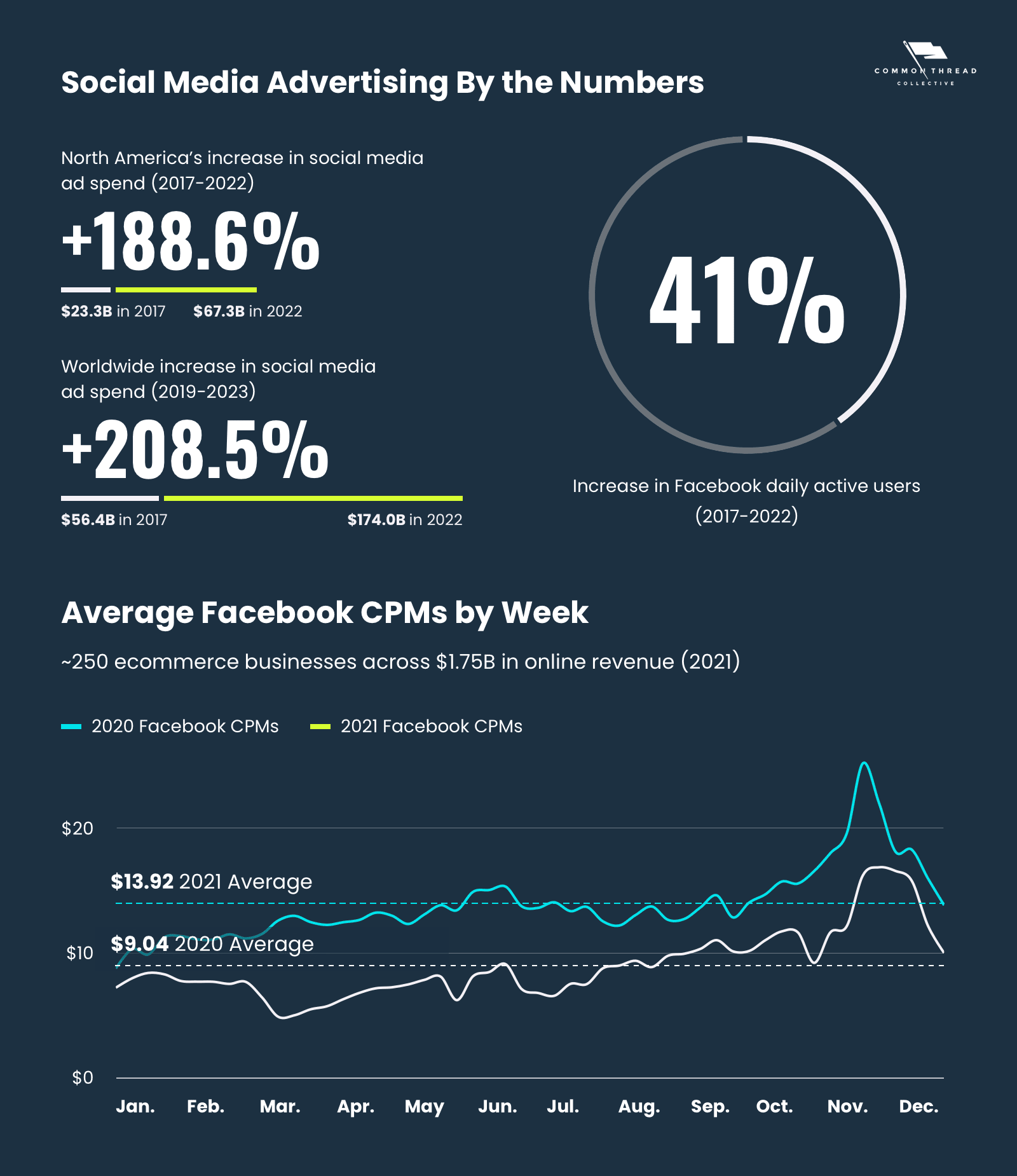

As worldwide ad spend increased by over 200% since 2017, Facebook active users have only gone up 41%. Worse, the cost to advertise on Facebook — for ecommerce brands specifically — has skyrocketed 53.9% YoY.

Certainly, diversification possesses breakout stars.

In addition to the options mentioned above, DTC is moving into traditional media (print, OOH, TV, and radio) as well as other discovery channels: namely, Snapchat, Pinterest, and YouTube. Not only are impressions and clicks cheaper on less saturated networks, but organic reach remains strong.

Nonetheless, defined in terms of “the same or better returns than Facebook,” such channels simply don’t exist.

Worse than a myth, diversification is a siren song that will lead many DTC businesses onto the rocks. This isn’t anti-diversification; rather, it’s about redeeming the sequence of pursuit and what we mean when we say it.

Facebook and Instagram are the highest-performing, most-efficient sales channel in human history. Why? In a word: data.

For years, Facebook has had a pixel sitting on virtually every website on the Internet, tracking in-app behavior across owned and rented land. That data has given birth to a map of purchase intent unlike anything else in the world.

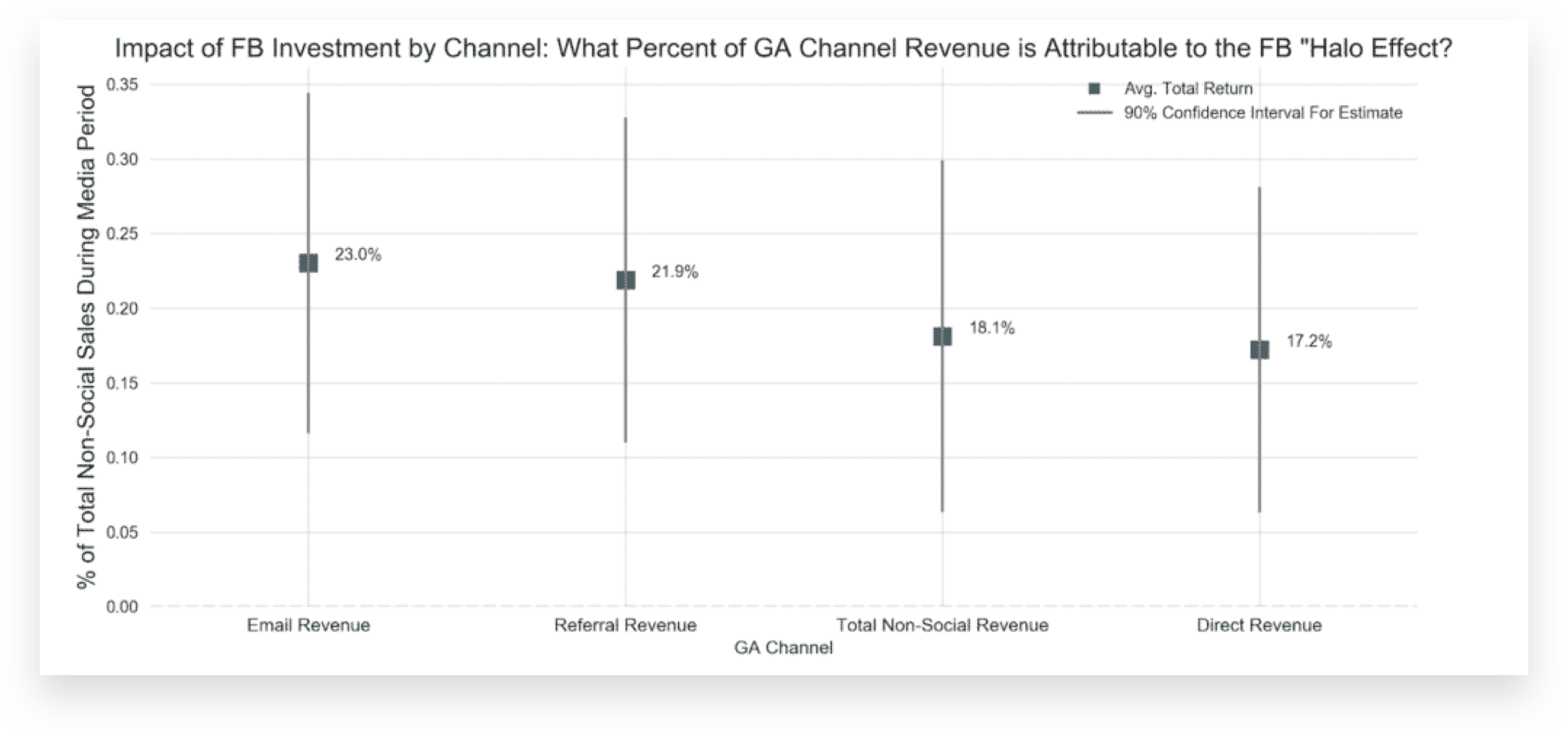

Even as the percentage of new advertisers has outpaced new users, revenue per user has increased 83% over the same period. Add to this the “halo effect” of Facebook on other channels — as documented by Adam Doolittle and Sam Isaac — and the numbers themselves paint a different portrait.

Recent developments to iOS 14’s App Tracking Transparency Framework (ATT) and changes to Facebook’s attribution window haven’t dethroned the platform. (More on this below.)

Experimentation with emerging channels is wise. As is linking campaigns from those new channels to Facebook remarketing efforts once a visitor has arrived on site.

Facebook’s understanding of intent, however, has not reached set-it-and-forget-it status.

On the buying side, five points deserve emphasis:

- Feeding a variety of social-media ad creative into a consolidated account structure to find successful combinations

- Setting clear prospecting goals to acquire customers at scale and fill your retargeting funnel

- Separating remarketing (retargeting) audiences with clean exclusions for visitors, reengagement, cart-abandoners, and customers

- Calculating Facebook budgets and CPA targets around the unit economics of your products or collections

- Eliminating single-account ROAS and instead adopting an LTV-centered approach (without waiting a lifetime)

4. Retention Accelerates Because You Can’t Wait a Lifetime for LTV

When calculating a customer’s value, a “lifetime” is a long time. Far too long for any business that operates under the real-world demands of cash flow. In one sense, LTV is the single most important ecommerce business metric. In another, it’s meaningless.

That paradox is why cash multiplier serves as a better conceptual model: 60-, 90-, or 120-day payback windows depending on your products’ reorder, repurchase, or upsell cycles.

By way of definition …

Customer lifetime value (LTV or CLTV): The revenue value — future cash flows — of an average customer over the course of his or her entire relationship with the company.

Customer acquisition costs (CAC): The total amount it costs to acquire an average customer, including agency fees.

Cash multiplier (60-day LTV): The revenue value of specific customer segments over limited time frames adjusted for sources and entry points.

Beneath a cash-multiplier reframing, LTV:CAC will take center stage as the central ratio in growth.

Tragically, LTV isn’t a built-in metric on any native ecommerce dashboard. most often, brands resort to spreadsheets or customer relationship management software (CRM).

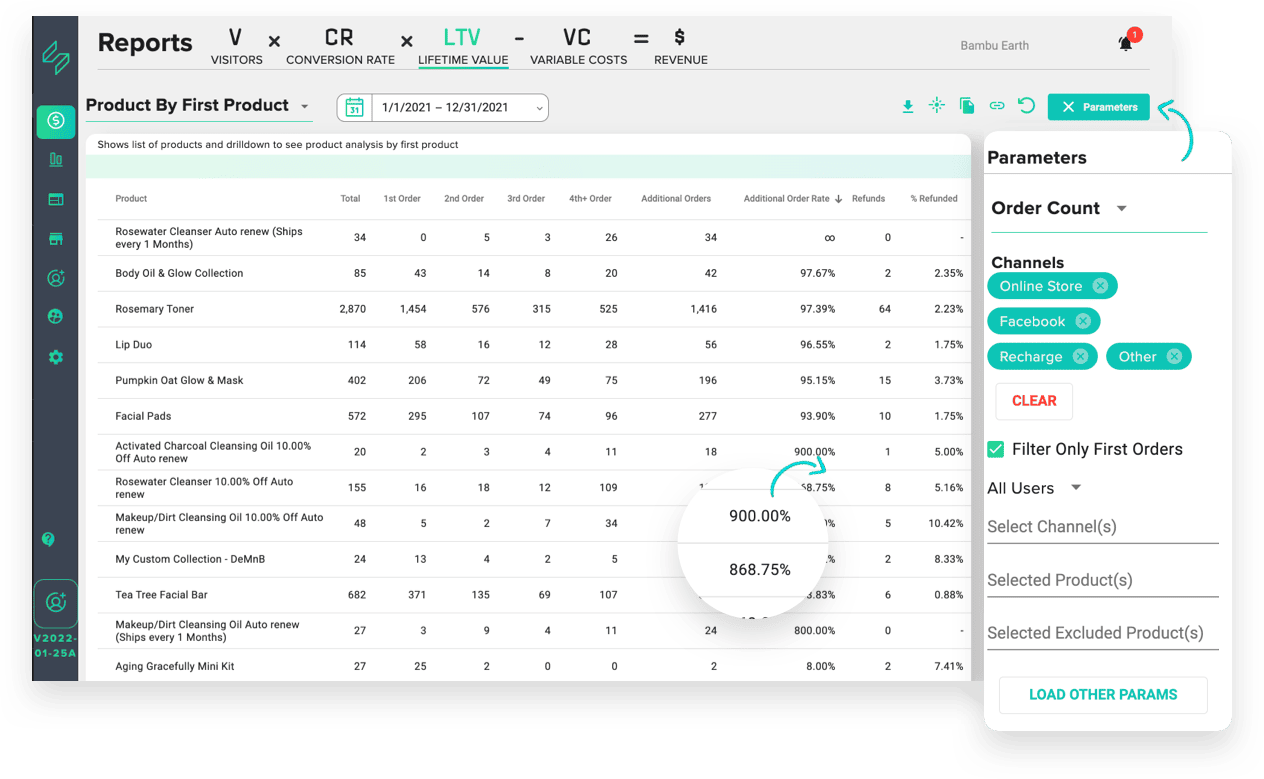

At CTC, the first iteration of this method was developed in house for one of our 4x400 brands, Bambu Earth. The analysis completely transformed our understanding of the business. Tracking LTV by first-product-purchased was the cornerstone of a strategy that resulted in 29x revenue YoY.

“Metrics that first indicated monthly losses from paid media,” explains Andrew Faris, CEO of 4x400, “were actually profitable over a longer time frame. We just needed to track what our customers did after they’d made their first purchase. What we discovered was that they were doubling and tripling their value to us within 90-120 days.”

Since then, LTV analysis has been streamlined to track customer value from multiple data sources through our tool, Statlas:

Such data unlocks a host of insights that can then show the value of customer retention based on:

- First product purchased

- Time of purchase (seasonality)

- Acquisition channel, campaign, or offer

- And, demographic characteristics by segment

By knowing and then optimizing acquisition strategies starting with retention, brands can begin exorcising the most dangerous demon haunting DTC …

5. Ecommerce Businesses Turn to Profits & One ‘Future’ Formula

For all its complexity, ecommerce growth comes down to four metrics: visitors, conversion rate, LTV (cash multiplier), and variable costs:

(V x CR x LTV) - VC = $

As more brands move from revenue-focused models to profit — from market share to dollars in their pockets — it will become critically important to know your variables and take hold of those with the highest likelihood of impact.

“In the early days of Stitch Fix,” recalls Mike Duboe, “Katrina [Lake, Stitch Fix founder] had a hard time raising capital, so, she was like, ‘Fuck this. We’re gonna become profitable and control our destiny.’”

It’s a telling sentiment, particularly when you consider the source.

To many, Duboe represents a shadow cast across DTC. Although he served as the Head of Growth at Stitch Fix, Duboe is now a venture capitalist at Greylock Partners.

VC money has led to much DTC heartache — think Casper, Outdoor Voices, and Brandless. The accelerated demands capital brings with it puts brands in a position to grow by any means necessary: prioritizing market share and new customers above all else.

By and large, the effects of this over dependence are well documented. It’s alternative, not so much.

“At Stitch Fix,” says Duboe, “we actually had a team of data scientists that were just focused on performance marketing. Around them was the larger team of marketers, product people, and finance. The aim was to align cross-functional groups around business levers. The broader trend of optimizing for downstream client value versus upfront acquisition cost was one of the biggest shifts during my time there.”

“As an investor, when you see payback tied to some ‘lifetime’ value years out, you almost always discount that. Profitable, healthy growth often comes less from focusing on CAC and more from focusing on understanding who is likely to be retained as a high-value user and then differentially focusing to acquire them.”

The turn to profitability — especially from the VC side — is a welcome respite. Moreover, it’s a turn that means funding itself need not be the enemy.

For all its complexity, profitable growth comes down to four metrics: visitors, conversion rate, LTV (your cash multiplier), and variable costs.

Without hyperbole, that single equation is the future of ecommerce.

In fact, we’ve drawn a line in the sand with two resources — alongside a fundamental shift in how we structure client relationships. One, a guide on centering your ecommerce analytics on the equation. Two, this tutorial detailing its development and implementation:

As more brands move from market share to dollars in their pockets, knowing your variables and taking hold of those with the highest likelihood of impact will define success.

And that means …

6. Online Shopping Compounds Gains with AOV Optimization

In-cart upsells for “Mystery” items and one-click, post-purchase offers. Tiered discounts through spending thresholds and installment plans to lower friction. Subscription incentives for monthly recurring revenue. Loyalty programs that exude “VIP.” And, behold, the still almighty email.

The best tactics aren’t big. But, their sum is greater than their parts.

Much has already been made about the value of brand, audience, and ethos. Not only here, but elsewhere in the developing DTC canon. Regularly accompanying that trifecta is the term moat: “durable competitive advantages levied by a particular business against its competitors.”

Outside legitimate innovation, whose half-life is increasingly brief, the only enduring moat is brand equity. Traditional online “sales” tactics undermine equity. Are therefore dangerous. And ought to be eschewed.

(Or, so goes one common argument.)

As a microcosm of this thinking, over the last two holiday seasons, leading ecommerce stores offered no discounts, minimal discounts, or charity-based incentives:

Does this mean price and optimization are things of the past? Hardly.

DNVBs who hosted holiday promotions — and the majority did — delivered them in ways that drove conversion rates and AOV without sacrificing brand value.

Even an abbreviated summary of holiday deal structures and offers shows how varied these tactics can be:

While that breakdown is telling, it points toward a larger truth. The best tactics aren’t big. Yet, their sum is greater than their parts.

Tactical options abound …

- In-cart order bumps for “Mystery” items

- Bundlers or builders atop product recommendations

- Financing options displayed across a site to lower friction

- Mobile-first checkouts via Apple Pay, PayPal, Amazon Pay, etc.

- And, tiered discounts through spending thresholds calculated without coupons

There's also subscription incentives for monthly recurring revenue. Essentially future-proofing your business by tapping in to the power of recurring revenue.

Add to that, membership programs that exude “VIP.” Referrals that breed community. One-click, post-purchase offers — upsells, downsells, and cross-sells (regularly presented in immediate and varied succession).

If anything, the problem isn’t a lack of options but knowing which to prioritize. Most brands aren’t dying of thirst; they’re drowning in an ocean of choice.

“People come to me for email, customer onboarding, and long-term retention,” says Val Geisler, Customer Evangelist at Klaviyo, “but, ultimately, the through-line for any of those problems is people.

“If you think about tactics solely as numbers you need to fix, you’ll inevitably lose sight of what can actually fix them. But, if we think about tactics in terms of people we need to serve better — whether that’s through products, onboarding, messaging, experiences, whatever it is — we’ll start with the people and always end with people.

“Your problem isn’t a number. Your problem is the people behind that number. So you have to talk to them.”

The solution is to take note of the optimizations mentioned. But, as an immediate starting point, quantify your customer’s existing pain points and then solve with best-fit tactics. This can be done through:

- Immediate post-purchase surveys

- Live chat before, during, and after purchase

- And, above all, spending time with them one-on-one

7. Multi-Channel Unites Demand Generation & Demand Capture

The proliferation of channels presents two challenges: one, structural; the other, tactical.

The former calls for marketing that aligns channels with your goals and competitive opportunities. The latter, bringing together social, search, and point-of-purchase into a single funnel.

Today’s path to purchase is a meandering customer journey that might begin on Amazon and end at a physical retailer or through an embedded buy button within an onsite Instagram feed. Along the way, online shoppers may be nudged through organic search results, retargeting sequences, or content delivered through paid distribution.

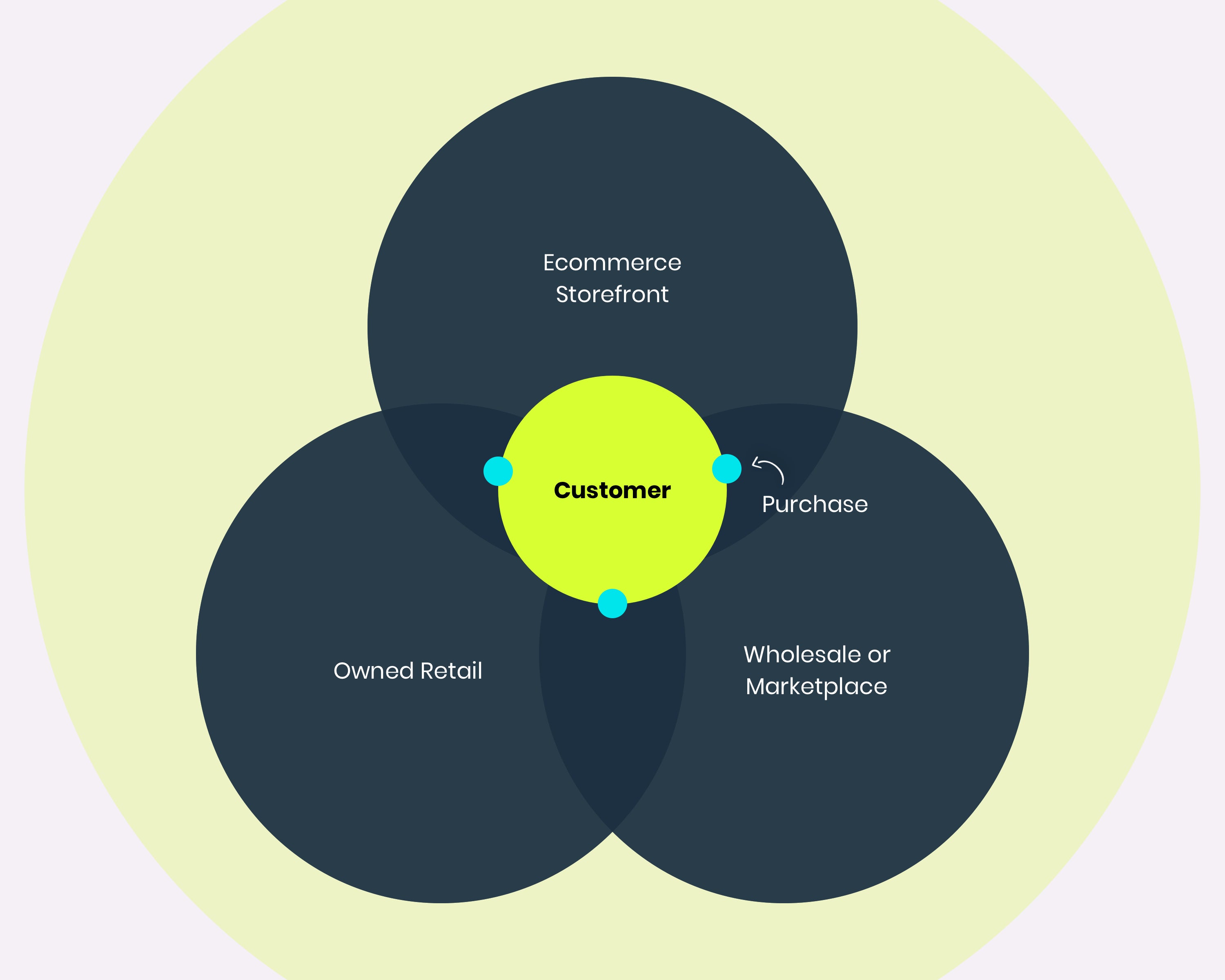

In response to diversification — to use platform parlance — retailers are adopting either multi-channel marketing or an omni-channel model.

With the former, ecommerce storefronts, online marketplaces, social commerce, and digital communities all become purchase points. There, customers can buy via discrete, “native” gateways.

More simply, multi-channel is a purchase-centric approach:

With omni-channel, brands bring those points together in what’s designed to be a customer-centric user experience that overlaps and interlocks:

Structurally, multi-vs-omni isn’t an exercise in word-play. The differences matter, especially when it comes to retailers merging O2O through too-often disjointed tech stacks.

For DTC brands, however, connecting demand generation with demand capture matters more.

“I’ll take a 30-second YouTube view any day of the week,” explains Bryant Garvin, CMO of Groove Life and previous Director of Advertising at Purple.

His justification? People go to Facebook versus YouTube for very different reasons. A renaissance of human-centric marketing must honor multi-channel intent. So too must attribution.

“On YouTube, even if an ad really engages you, the likelihood that you’re going to stop, click, and ignore the reason you went there in the first place is almost zero. What you will do is later go search for that brand. A 30-second view means someone’s electing to not hit the skip button. The sound is on; they’re engaged in an immersive experience.”

As for attribution, Garvin suggests a “directional” model, dollars out versus dollars in: “A lot of it’s manual right now because I want people to understand the numbers so when something’s off, it grabs their attention.

“For those of us that grew up in digital performance, we’re so used to the data that we’ve almost forgotten what marketing is. There’s a person on the other side of that window. And people are nothing if not erratic and emotional. If you’re not creating an emotional connection to somehow trigger that subconscious response, it’s not happening.”

No matter the channel, as DTC spreads its wings beyond owned funnels — tight cycles of paid-to-onsite and subsequent retargeting — a gap emerges between awareness, interest, desire … and action.

This becomes especially painful when you consider the natural path to purchase as purchase points multiply.

In addition to generation, DTCs must weigh capturing demand: namely, the margins between creating awareness, interest, and desire via social and the final action through branded search versus wholesale partners.

8. Creative Content Anchors Itself in the Funnel’s Analytics

In the wake of high-profile launches, numerous incumbent and DTC retailers have met content disaster. Amidst that bleak backdrop, can content and commerce be profitably united? Yes.

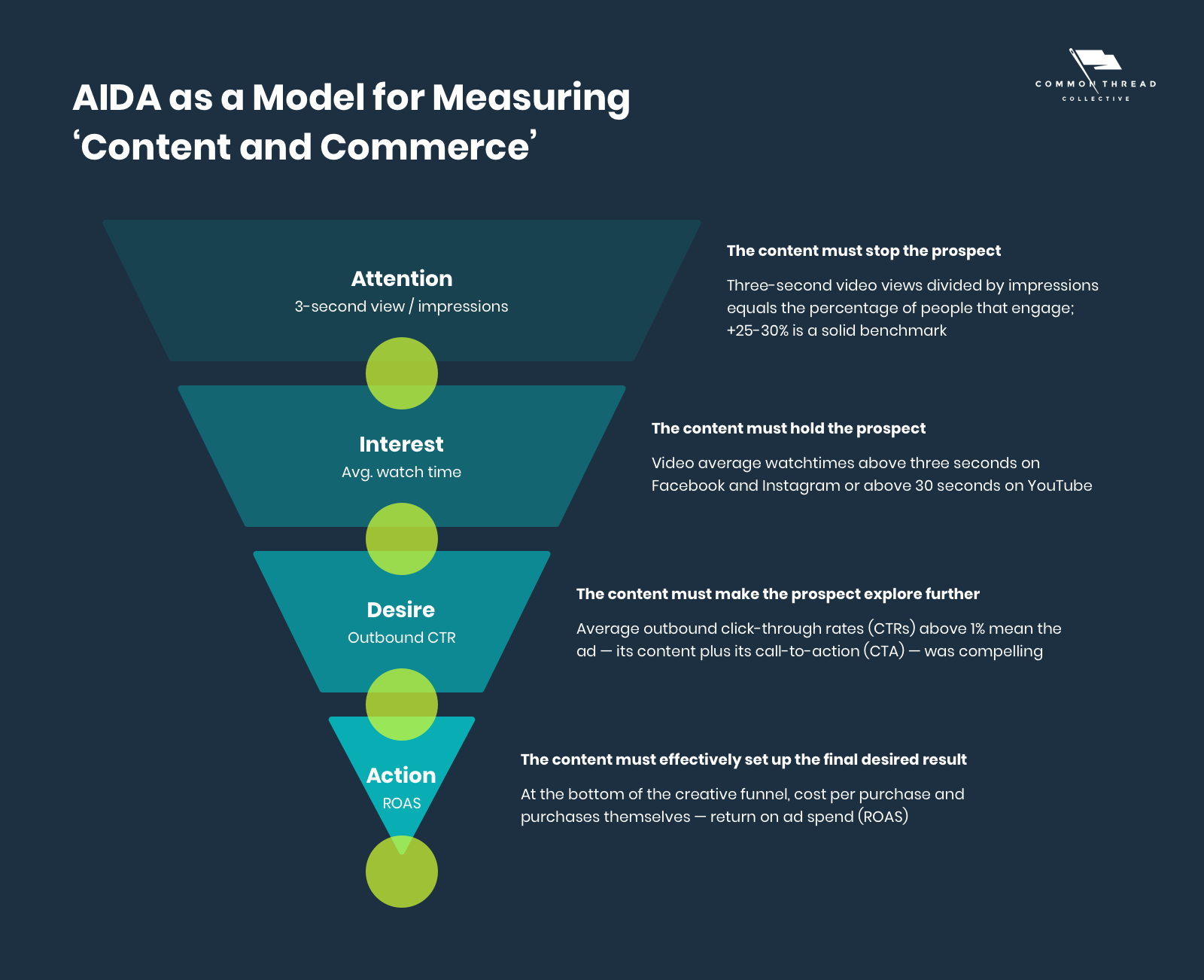

What unifies retailers proving content’s worth is (1) a creative strategy that repurposes storytelling and aesthetics in paid media and (2) a tactical strategy governed by AIDA analytics.

Often misunderstood, the power of ecommerce content resides not so much in its direct ability to sell — although it can.

The power of content lies in entering an audience’s heart and mind through a consistent story well told; one with people, not products, at its core.

“In paid social, it doesn’t matter how good your strategies are,” explains David Herrmann. “Your audience needs to connect with your content first. It’s the kindling. It’s what drives inspiration. I can’t make people money unless they keep feeding me content. If sales are down, if traffic is more expensive, blame content.”

Of course, not all content is created equal.

Data shows that never before have so many B2C companies produced so much B2C content with such little attention to B2C results.

What makes the difference?

“Successful brands heavily use written, audio, visual, and experiential content to drive full-funnel marketing campaigns: awareness, interest, desire, and action,” explains Nik Sharma. “Great content doesn’t sell a product, it sells an opportunity to better an aspect of your life.”

That’s a prescient diagnosis, especially Sharma’s emphasis on awareness, interest, desire, and action — more commonly known as AIDA.

Two factors have conspired to make content the leading competitive advantage for ecommerce brands.

First, a long-overdue realization pitting brand versus performance is toxic to both. Second, machine-learning advancements that have all but leveled the playing field for buyers.

This doesn’t mean divorcing creative questions from analytical answers.

“We’ve spent the last couple of years mapping AIDA to real numbers,” says Richard Gaffin, Senior Copywriter here at Common Thread Collective. “Because video content is the lifeblood of successful strategy, the objective was to establish a mathematical relationship between (a) an ad’s creative content and (b) the expected value of a response. Their moment by moment experience of an ad.”

The outcome is a model linking objective KPIs to subjective experiences.

- Attention: The content must stop the prospect

Three-second video views divided by impressions equals the percentage of people who engage. Above 25-30% is a solid benchmark, though the aim should always be to beat your best.

- Interest: The content must hold the prospect

Video average watchtimes above three seconds on Facebook and Instagram, or above 30 seconds on YouTube, are great indicators that people are genuinely hooked by your creative.

- Desire: The content must make the prospect explore further

Average outbound click-through rates (CTRs) above 1% mean the ad — its content plus call-to-action (CTA) — was compelling enough to get someone to take the first step toward action.

- Action: The content must effectively set up the desired result

Finally, for sales, it’s all about cost per purchase and purchases themselves — return on ad spend (ROAS)

Beneath those guiding principles, content can take a host of creative forms.

Not merely as fuel for ads, but as an audience-building strategy to overlap with paid by repurposing organic storytelling in all its glory.

Retailers proving content’s worth unite two factors.

One, a tactical strategy governed by results. “If it doesn’t sell, it isn’t creative” (David Ogilvy). Two, a creative strategy embracing aesthetics as a medium to enter the story your audience already inhabits.

“I’ve always looked at content as the main driver for our advertising,” Matt Taylor, the founder of Tracksmith, explains. “Brands that do content and commerce best understand that when the story comes first, the rest follows.”

9. SMS > Social Commerce for Intimate Customer Experience

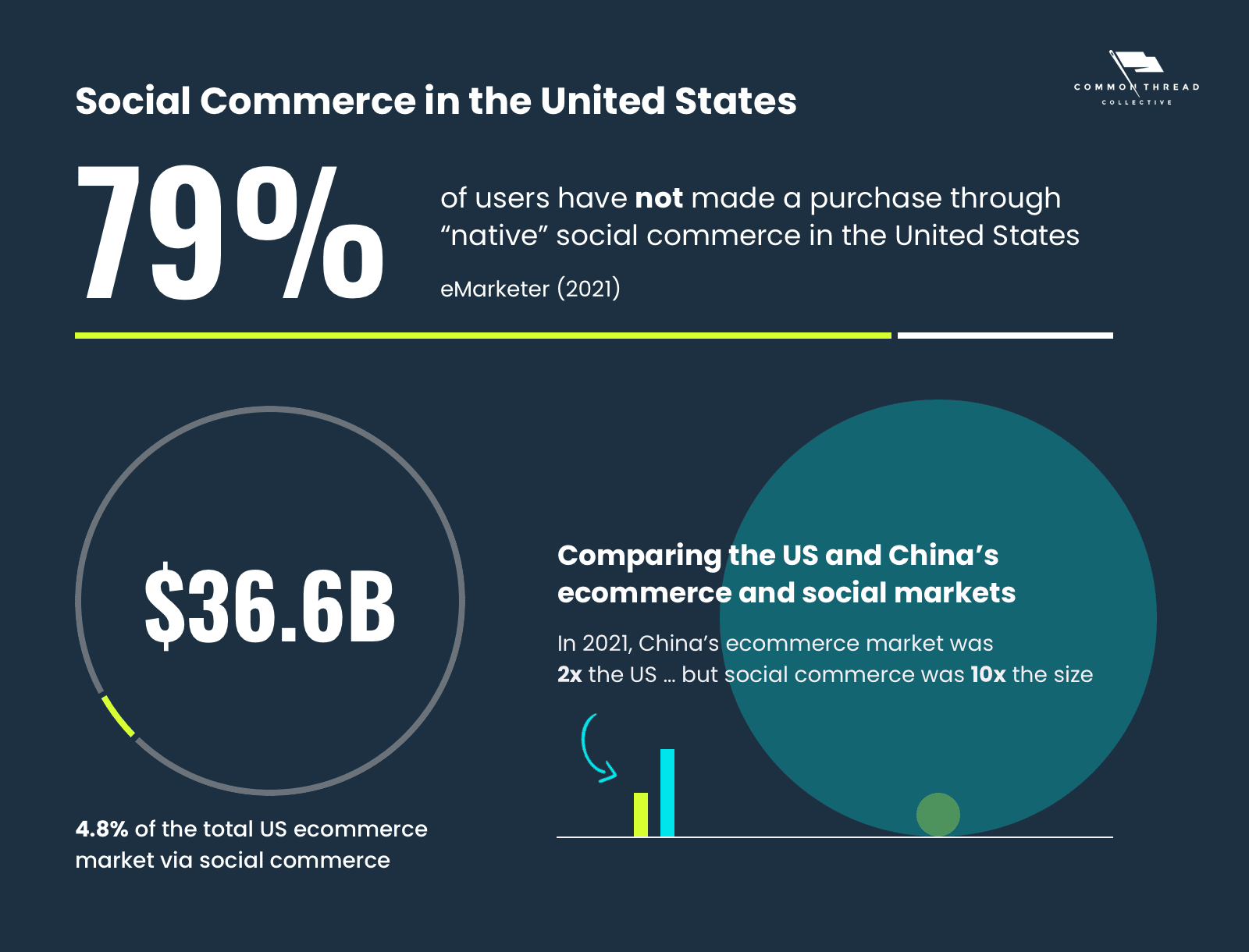

Despite the hype surrounding in-app purchase options on Facebook and Instagram, consumers aren’t buying. With low incentives to make native selling work, don’t expect salvation to come from the social networks — not immediately nor outside a seismic acquisition.

Intimacy with customers won’t be accomplished via social, but instead through tiny keyboards with huge payoffs.

By every big-picture metric, social media and in-network commerce should be a match made in heaven. Worldwide penetration, active accounts, and time spent are up across the board.

The promise of shortening the funnel, allowing customers to buy instantly, and reaping the rewards of intimate relationships has long been foretold.

Unfortunately, there’s a disconnect.

Despite the release of numerous “native” purchasing features … social users aren’t buying.

Rumors continue to swirl around Instagram and Facebook developing its own ecommerce sales platform and Mark Zukerberg took a leap in that direction last year during an earnings call.

However, after Amazon posted two straight years of +50% growth in ad revenue and with Apple’s advertising catapulting from $500 million in 2018 to $5 billion in 2021 …

Even on marketplaces and platforms, the money’s in the ads — not the purchases.

With low incentives to make native selling work, don’t expect salvation to come from the social media platforms (not immediately nor outside of a seismic acquisition).

Going native and getting intimate isn’t about social. It’s about “tiny keyboards” … from the bottom of the funnel, up.

“SMS and mobile messaging will overtake all channels as the primary source for people to reach out,” says Vanessa Skaggs, Marketing Manager at Pura Vida Bracelets. “It’ll all take place on little, tiny keyboards on a phone.”

As evidence, Skaggs points to digital movements like “VSCO girls,” recently covered by The New York Times in relation to Pura Vida.

“When a VSCO girl laughs,” explains Skaggs, “it’s ‘SKSKSK.’ It doesn’t sound like laughter. But if you look at your phone keyboard, where are S and K buttons located? Immediately underneath your thumbs. So, ‘SKSKSK’ has replaced ‘LOL’ or ‘Hahaha’ — even though H and A are maybe one or two keys more inside.”

“With ecommerce trends like that, future generations will find ways to take mobile shopping, mobile checkouts, mobile payments to another level. Messenger platforms, SMS, and chatbots.

“Hardwired mobile users whose expectations of online shopping won’t be limited to ecommerce stores or ecommerce sites.”

Although Gary Vaynerchuck’s WineText may be the most visible illustration, it certainly isn’t alone. Across the funnel, SMS in all its varied forms is one of the few buzzwords worthy of the title.

“9,165 people are on it,” Vaynerchuck told Web Smith on Polymathic. “It’s outperforming our email service that has 400,000 people on it 15x. Very simple sign-up. You go to it, put your credit card in, and then every day you get a text. All you have to do is reply with a number. And the friction is gone. It’s fucking slain.”

Customers are adopting Facebook Messenger and SMS at an exponential rate. DMs sent between individuals and businesses total twenty billion every month. Why?

“Consumers feel about messaging with brands the same way they do about micro-influencer marketing,” notes Katie Krische, the Marketing and Partnership Manager at Octane AI.

“Because they’re delivered where young and older people feel at home and because they’re one of the few remaining one-to-one methods of communicating, trust is higher and relationships can develop through engagement.”

Arri Bagah, founder of DTC Day and Conversmart, drives home those points:

“Brands have to reach their customers where their customers are. Never the other way around. The average person spends about four hours a day on their smartphones. And they’re spending them within apps like iMessage, Messenger, WhatsApp, and the DMs.

“With average open and clickthrough rates that demolish email, brands can no longer ignore SMS as a viable channel to reach customers, build meaningful relations, and generate millions of dollars in incremental revenue.”

10. International Ecommerce Almost Becomes the New Normal

For the first time in history, the world is within reach. Though navigating beyond borders is not without its challenges.

Once the purview of global conglomerates, medium retailers can begin selling across the world with the flip of a switch.

“Who wants to call BS? Don’t be shy.” Alongside big-picture data, one brave owner pulls back the curtain.

At the start of 2020, 1.35 billion people were in the global “middle class” with the majority of the middle-class growth in the Asia Pacific region.

While the middle-class growth in Asia slowed with the arrival of COVID-19, ecommerce’s gravity has already moved East and will continue to do so as large population centers continue to generate more disposable income.

For the first time in history, the world is within reach.

Though navigating beyond borders is not without its challenges. Once the purview of global conglomerates, medium retailers can begin selling across the world with the flip of a switch — literally.

“Who wants to call BS? Don’t be shy.”

Those aren’t my words. Those are the words of Patrick Coddou, founder and CEO of Supply. His next words? “You don’t have to be a genius.”

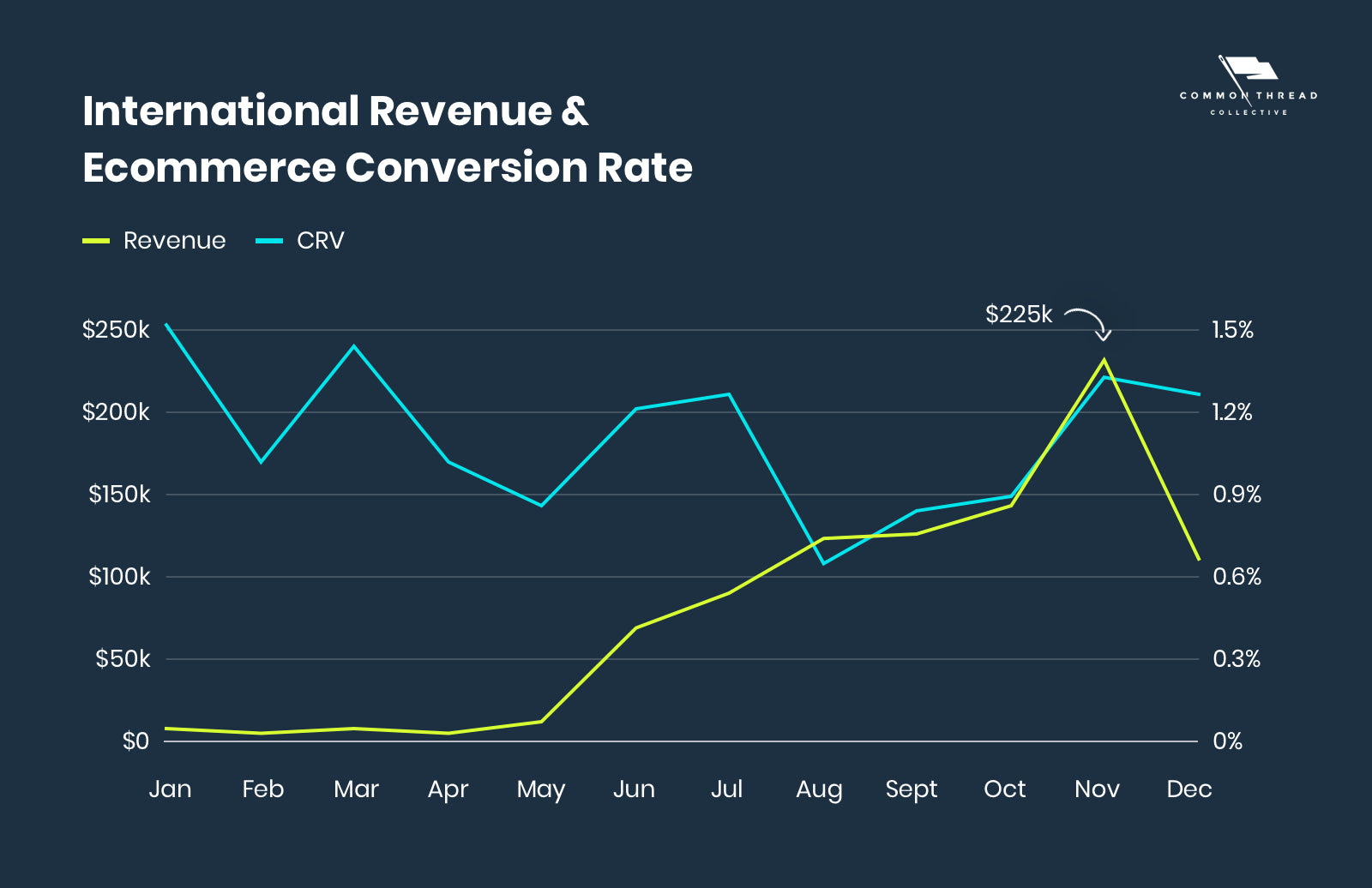

“Early last year, we decided to duplicate our domestic ads, change the targeting from US to worldwide, set language to English, and hit go,” Coddou says. “The end result was 30% of revenue coming from international markets. From zero to $250k in Nov. alone. Obviously, there was a lot of tweaking and lessons, but that’s how it started.”

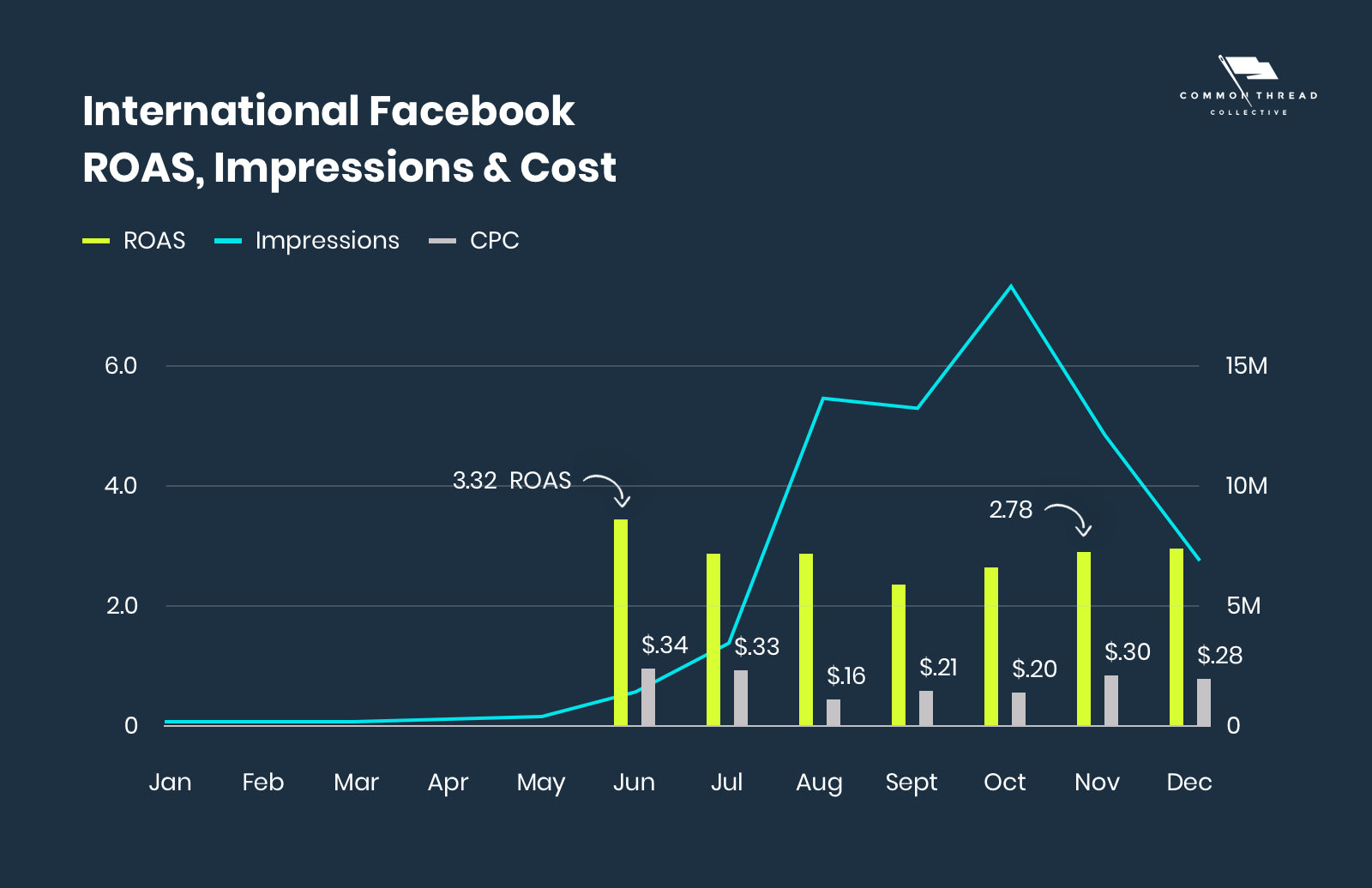

Between Jan. and May, the ads ran with essentially zero attention — minuscule impressions of around 100-500. In June, Coddou and CTC’s Senior Media buyer Trent Kerth turned up the spend and hit a 3.5 ROAS out of the gate.

So, they turned it up and both Supply’s international as well as domestic returns held:

Interestingly, those initial results didn’t include many of global ecommerce “best practices” often heralded. Supply enabled international currency in late Oct. through Shopify Plus. As for translation:

“At this stage of my business, I have zero interest in allocating resources, time or money, to translating the website. Once you do that, you start getting emails in that language, then you start having people expecting instructions and support in that language.”

Coddou’s experience doesn’t rule out those sort of considerations. Depending on the region a business may target along with the size of the operation, more native efforts may be warranted.

Once known for sourcing and manufacturing, tapping into China and the larger APAC market is now a frontline strategy.

Rothy’s, for instance, built a team in Shanghai to begin selling. Its entry point was WeChat. Everlane and Allbirds have also identified China the “horizon for future expansion.” And 100% Pure has leveraged Tmall Global in conjunction with Juhuasuan — an influencer-led flash-sale feature — and a third-party logistics provider that lets it sell into China while staying true to its cruelty-free production.

Supply’s route illuminates a road toward cheaper traffic and higher returns for brands of any size:

Don’t back off from global opportunities. Instead, find creative workarounds and trusted partners. Prepare your infrastructure for the challenges of shipping through fulfillment partners and international warehouses.

Or, as Coddou puts it: “Just turn it on and see what happens.”

Apple’s iOS 14 Privacy, Headless Commerce & Progressive Web Apps for Mobile Devices

No 2022 “ecommerce trends” guide would be complete without at least a nod to three phrases — to say nothing of NFTs and Web3’s ecommerce influence. Here, we’ll round out with a quick summary of …

(1) iOS 14 Privacy & Facebook Ads

With the advent of iOS 14.5, Apple users began receiving the ATT Prompt — giving them the choice to opt-in or opt-out of data tracking.

Before, the Facebook Pixel could track all iOS users to coordinate in-app impressions and onsite activity. Now, that data is limited. Moving forward, Facebook advertising will:

- Record day-of conversion events for all purchases

- Be limited to eight events per domain, ranked manually

- Only track the top-ranked event for users that opt-out of ATT

- Replace the 28-day click attribution window with a 7-day window

- Model advertising activity through Aggregated Event Measurement

Does that mean the sky is falling? In short, no. To learn more and prepare yourself, we’ve created a living document to track iOS 14’s impact on ecommerce as it occurs.

(2) Headless Commerce

As the name implies, “headless” refers to separating the face of your ecommerce website from the body, its functional parts.

While conventional online stores operate their front- and back-ends on a single ecommerce platform — i.e., one ecommerce website that runs everything — a headless configuration divides the two.

Front-end user experiences are hosted on a content management system (CMS) for website visitors in conjunction with omni-channel expressions: e.g., marketplaces, social networks, retail locations, and mobile applications.

Back-end operations are then governed by a combination of an ecommerce checkout (cart), enterprise resource planning tool (ERP), and/or customer relationship management software (CRM).

(3) Progressive Web Apps

Closely associated with headless is what’s known as PWAs: mobile websites that function as standalone apps to enable instant loading, saved user data, and offline modes when connectivity is poor.

Both Shopify and BigCommerce have invested heavily in the infrastructure necessary to run headless commerce and PWAs. Both have also invested heavily in marketing those capabilities: see Shopify Plus’ Headless Commerce is Flexible Commerce or BigCommerce’s The Headless Commerce Showdown.

Even so, the price tag for either will likely exclude implementation. Which is fine.

Far more vital is shoring up mobile shopping weakness by adhering to another short checklist …

- Prioritizing mobile speed over desktop

- Utilizing made-for-mobile personalization

- Implementing mobile-first payment gateways

- Creating mobile product pages with lite content

- Adding impulse purchase buttons on product pages

- Minimizing steps to purchase (e.g., clicks and screens)

- Optimizing for mobile and desktop conversions separately

Top Ecommerce Trends & DTC’s Future: Behold, ‘Good News’ for Growth

DTC leaders are facing a world of opportunity to evolve or perish, with success coming from big and small steps alike.

“The most successful modern brands aren’t just setting themselves apart through the tactic of selling direct to consumers,” says Dan Frommer, Founder and Editor in Chief of The New Consumer, “but through their broader sensibilities.”

“This includes their approach to product development, customer experience, storytelling and marketing, values, community building, and yes, sales and distribution strategies. The way many responded — opening physical stores, selling wholesale into other retailers, etc. — isn’t just a response to rising ad costs, but overall maturity.

“Some of this is out of necessity, to grow into their valuations. Much is because the opportunity is real.”

“Hearken! Behold, there went out a sower to sow …

“Other fell on good ground; and it yielded fruit that sprang up and increased and brought forth: some thirty, and some sixty, and some a hundredfold.” And He said unto them, ‘He that hath ears to hear, let him hear.’” — Mark 4: 3, 8-9

We won't send spam. Unsubscribe at any time.

Previously the VP of Marketing at CTC and Editor in Chief of Shopify Plus, Aaron is now the Head of Marketing at Recart SMS. His content has appeared on Forbes, Mashable, Entrepreneur, Business Insider, The New York Times, and more. Connect with Aaron on Twitter or LinkedIn.